With the evolution of the ETFs market, they now covered numerous products and varieties. You are able to go long or short and you are able to take a leverage position of up to 3X. There is even a Bitcoin ETF in the making.

Most of the interesting ETFs are listed in the US markets whereby some are seriously just not suitable for the normal retail investors due to their structure.

The advantages of the ETFs have been widely preached with empirical studies showing most fund managers are not able to out-beat the market. So a passive approach with lower management fees and expense fees would be considered a more effective way of getting exposure to the markets. However, with the sales charges of most unit trust being cut to close to 0.5%-0.75% and if you chance upon a promotion, it could be even zero percent.

So this brings unit trust to be on a more level playing field. The spread of ETFs plus the brokerage commission could be equivalent to the 0.5%-0.75%. This brings it in line with the sales charge of unit trust. So the only thing that ETFs stand out will be the management fee which usually gives it an edge of around 0.5%-1% per annum.

However, some of us would not mind paying the extra in the quest to find the next Warren Buffet or Peter Lynch whom are able to give us market beating returns.

ETFs are mainly divided into replication and representative types. Replication types usually will buy the physical underlying to replicate the performance of the markets. On the other hand, Representative types are usually structured using derivatives products.

For those who are dealing with Representative ETFs and with added leverage feature, you have to be "Ready to Trade" rather than have a "Buy and Hold mentality". Most Representative ETFs make use of futures products to create a proxy for the underlying. Most futures exhibit Contango characteristics which means longer term futures contract are trading at a higher price than shorter term futures contracts which are usually traded as they are the most liquid.

So whenever the shorter term contracts expired, the ETFs managers would have to roll over to the next contract which they have to get at a higher price so it will lead to an erosion of the Net Asset Value since he can only buy fewer contracts. If you add leverage to the picture, it is definitely not an exciting proposition for buy and hold investors.

Citing an example, Ultra Short Vix ETF (UVXY) which has a leverage of 2X and was trading at around $11-$12 when Vix was near their range low of around 12 in Febuary 2013. Recently, VIX is back to around the 12 level and the same ETF is trading at around $3.5 (Not taking into consideration the 10 for 1 consolidation). Enough Said I Guess.

To conclude, for buy and hold investors, just stick to the normal replication ETFs with no leverage. For those into leverage and representative ETFs, do take it as a trading instrument which I personally will not hold for more than a month, unless it is moving in sync with your intended direction.

Lee

Wednesday, 21 August 2013

Wednesday, 14 August 2013

Van Gogh The Life

Being one of the most famous impressionist artists of the 19th century, this book provide insights and depict in great details on the life of Van Gogh. He lived from 1853 to 1890 and die at a young age of 37. He is more of a loner from young and was never well liked.

This biography touches on the special relationship between his younger brother and himself which indirectly led to his mental condition in the later stages of his life. He started selling art prints at his uncle's art gallery and he only started seriously painting during his late twenties.

As his style differed from the conventional art style which is of the renaissance era, so it was never widely accepted. Monet is part of this new revolution of the impressionist movement.

He led a tough life and depended on his younger brother for allowance as his paintings simply don't sell. He even married a prostitute as a wife who bore him a child. He was a total outcast and spend his later years in an asylum. This was where some of the greatest works were painted.

It is a very sad biography whereby he never reap any benefits from his masterpieces during his lifetime. He was eventually shot and die from the wound. It is still a mystery if he was trying to commit suicide or he was accidentally shot.

This book is around 900 pages and so it took me some time to finish it. After reading the book, it seems that the life of an artist is definitely not as glamorous during those days. Even in today's context, I guess it is still not a preferred route that parents would want their child to take.

Lee

Sunday, 11 August 2013

National Day Staycation

My family have just recently came back from a staycation at Ritz Carlton. We have booked the room hoping to get a room with a view of the National Day Celebrations.

However, it does comes with a premium and so we have to settled for the "Highway View". It can get pretty annoying in the night when u can hear the screeching sounds of the super cars on the road. I am one who seldom soak in the bathtub but at Ritz, it has a bathtub with a view and so who can resist :).

We mainly hang around the Marina Square area these few days and have try different eateries. We had lunch at Dian Xiao Er, dinner at Bao Jin Tian that serves decent dim sum (Custard Buns are really nice) as compared to their 313 Somerset branch. We also try the Sarawak Ko Lok Mee for breakfast which i find is slightly pricey. Had supper and lunch at Killiney and also had a meal at the food court.

We wanted to go and take the flyer but guess it will be really crowded so we give it a miss.

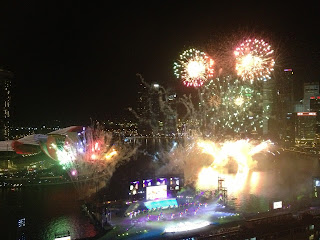

The highlight was of course to watch the fireworks and as our room is facing the highway, so we have to go to the lift lobby to get a glimpse of the spectacular fireworks.

It was a great short staycation for the long weekend. Hope everyone have enjoyed your long weekend too.

Lee

Monday, 5 August 2013

Dollar and Cents- Repairing a Car in JB (Is it Worth it?)

My current ride is coming to the 6 years mark and is starting to show problems due to wear and tear. I will just like to share my experience of repairing and replacing the different parts due to wear and tear through these past two months. For a start, I am driving a Toyota Altis 07 model.

I have re-sprayed the car earlier this year and have changed the colour. Due to the sky high COE price, I am likely going to drive it all the way till this car's COE expiry. Therefore, I guess this is a worthwhile investment to make me feel that I am driving a new car :). The cost of this vanity is around 1300 dollars.

The car started showing problems 2 months back with the battery first to go. I was unable to start the engine at all, I managed to find someone to come over to my place and replaced my car with an Amaron battery for around 150 dollars.

Next, my side mirror started to give a hissing sound and the root cause was a problem with the motor mechanism which means you have to change the whole side mirror. My fan belt is also starting to show cracks. The cost of replacing for the side mirror was 200 dollars and the fanbelt was 100 dollars.

After which I went to JB to do my servicing, it cost around 80 sgd whereas it cost from 140-160 sgd in Singapore. Thus, you can save about 50 percent. Also, I changed my air-con and engine filter plus a spark plug. On top of that, I change my car's auto transmission oil. All in, it comes up to around 200 sgd.

The mechanic advised me to change my front absorber but even though I did find the ride a bit bumpy but thought I can drag it for a while more. An important point to note, if your front absorber is starting to leak oil, do try not to jack it up as it will lead to the front absorbers getting spoiled at an accelerated pace. After the servicing, the car's front absorbers totally give way but as I have an engagement in Singapore so I was not able to do the change in JB. I was quoted around 220 to 250 sgd.

The ride was totally bumpy and feel like a boat ride after the front absorbers give way. I checked with a few Singapore workshop and decided to go with one that charges around 300 dollars for the original parts as it is not far off from the rate quoted by the JB workshop. There was one which quoted 588 dollars as they say they have to change the mounting rubber and etc while another quoted 445 dollars. All are before GST.

After I reached the workshop, I found out that the quote was without labour and so plus the labour and GST, the cost was around 385 dollars. Since I am already there, I guess I have to just go ahead and the car was in urgent need of a pair of brand new front absorbers.

I did some research while at the workshop and found that the cheapest cost is to get the parts from the stockist and get the workshop to fix it for you. I check with the stockist and found that a pair of original front absorbers was just 150 dollars. The workshop quoted me 300 dollars for it. Based on a simple calculation, with the labour cost at around 80 to 100 dollars, the total cost using this approach will be similar to the JB workshop quote and I can save around 100 dollars.

This is a sum up of the recent repair costs for my Altis:

1) Battery 150

2) Side Mirror 200

3) Fanbelt 100

4) Servicing in JB 200

5) Front Absorbers 385

Total costs $ 1035

To conclude, it is advisable to do your servicing in JB if you know any good workshops provided your car is a normal and not a luxury car as you can easily save 50 percent. For repairs and replacing parts, if you get from the stockist, the pricing will be quite similar to what is quoted by the JB workshops. I feel it is more prudent to change parts in Singapore. If you let the Singapore workshop get the parts for you, the total cost is likely to be 50 percent more than getting them from the stockist. If you happen to go to a workshop that is trying to make you a carrot head, it could be 80-100 percent more.

Lee

I have re-sprayed the car earlier this year and have changed the colour. Due to the sky high COE price, I am likely going to drive it all the way till this car's COE expiry. Therefore, I guess this is a worthwhile investment to make me feel that I am driving a new car :). The cost of this vanity is around 1300 dollars.

The car started showing problems 2 months back with the battery first to go. I was unable to start the engine at all, I managed to find someone to come over to my place and replaced my car with an Amaron battery for around 150 dollars.

Next, my side mirror started to give a hissing sound and the root cause was a problem with the motor mechanism which means you have to change the whole side mirror. My fan belt is also starting to show cracks. The cost of replacing for the side mirror was 200 dollars and the fanbelt was 100 dollars.

After which I went to JB to do my servicing, it cost around 80 sgd whereas it cost from 140-160 sgd in Singapore. Thus, you can save about 50 percent. Also, I changed my air-con and engine filter plus a spark plug. On top of that, I change my car's auto transmission oil. All in, it comes up to around 200 sgd.

The mechanic advised me to change my front absorber but even though I did find the ride a bit bumpy but thought I can drag it for a while more. An important point to note, if your front absorber is starting to leak oil, do try not to jack it up as it will lead to the front absorbers getting spoiled at an accelerated pace. After the servicing, the car's front absorbers totally give way but as I have an engagement in Singapore so I was not able to do the change in JB. I was quoted around 220 to 250 sgd.

The ride was totally bumpy and feel like a boat ride after the front absorbers give way. I checked with a few Singapore workshop and decided to go with one that charges around 300 dollars for the original parts as it is not far off from the rate quoted by the JB workshop. There was one which quoted 588 dollars as they say they have to change the mounting rubber and etc while another quoted 445 dollars. All are before GST.

After I reached the workshop, I found out that the quote was without labour and so plus the labour and GST, the cost was around 385 dollars. Since I am already there, I guess I have to just go ahead and the car was in urgent need of a pair of brand new front absorbers.

I did some research while at the workshop and found that the cheapest cost is to get the parts from the stockist and get the workshop to fix it for you. I check with the stockist and found that a pair of original front absorbers was just 150 dollars. The workshop quoted me 300 dollars for it. Based on a simple calculation, with the labour cost at around 80 to 100 dollars, the total cost using this approach will be similar to the JB workshop quote and I can save around 100 dollars.

This is a sum up of the recent repair costs for my Altis:

1) Battery 150

2) Side Mirror 200

3) Fanbelt 100

4) Servicing in JB 200

5) Front Absorbers 385

Total costs $ 1035

To conclude, it is advisable to do your servicing in JB if you know any good workshops provided your car is a normal and not a luxury car as you can easily save 50 percent. For repairs and replacing parts, if you get from the stockist, the pricing will be quite similar to what is quoted by the JB workshops. I feel it is more prudent to change parts in Singapore. If you let the Singapore workshop get the parts for you, the total cost is likely to be 50 percent more than getting them from the stockist. If you happen to go to a workshop that is trying to make you a carrot head, it could be 80-100 percent more.

Lee

Saturday, 3 August 2013

Sinopipe AGM and Experience with S Chips

I have recently went to the AGM of Sinopipe at Lion Industrial Building which is around Paya Lebar area. This counter is one of my "tuition fees" in the equity markets as like many other S-Chips, it is still suspended but at least they do come up with an AGM which I hope it would be a positive signal that it would not be a total write off. The other heavy "tuition fees" in my investment journey is the previous China Enersave which is now called YHM. With the huge dilution from the issue of new shares, it as good as a total write off. You could by now realise that my heavy "tuition fees" are both S Chips (China Enersave is not really a S-Chip but their business are in China) and not surprisingly, I have totally given up hope on this sector.

Just some background of what led to this investment, it is in the pipe making business and with China's urbanisation and infrastructure needs, it seems to be a viable good growth industry to be operating. Moreover, their Price Earnings Ratio was just around 5 and with Net Asset Value of 50 cents. So getting it at around 20 plus cents seems like a good proposition with a margin of safety. Furthermore, one of my clients did mention to me that he is using Sinopipe products in Singapore and find the quality is not too bad.

For those who can recall, the S Chips sector was a value investor's paradise, with counters such as China Hongxin trading at below their cash holdings and many meeting Benjamin Graham stringent requirement of having their current asset more than their total liabilities. Also, many have fallen from their lofty highs of 2 dollars plus to their current price level of below 20 cents. During that period, I was also vested in counters such as China Farm and China Paper which I managed to get out in time with profits on hand.

However, I failed to take into account or did not placed huge emphasis on corporate governance and think this is a situation of at least a "one bagger" opportunity. For Sinopipe, it has given out generous dividend which give me more confidence of the management and their corporate governance structure. It was around 10 percent or 2 cents per share. I was thinking this could be the "Special One" and even the CEO was saying that we should not "Taint all Ships with a Brush". Thinking back, what a Classic!

So my lesson from this is that unless there are really solid institutional investors backing such as GIC or Temasek (China Minzhong), we should avoid S chips as those Top Notch China Companies would try to list in Hong Kong first.

Back to the AGM, the room it was held was sort of a training room. There were around 10 shareholders who attended. As my shares are brought using CPF and am not entitled to attend, so I got a proxy from another investor, Sadly, they did not received the proxy form and so I ended up as an observer and was unable to ask any questions.

I can feel the tension in the air as the shareholders started questioning the directors about the accounting irregularities and the status of their previous CEO who was the cause of the current predicament. Surprisingly, he was still under the director list but as expected, he was not present for the AGM,

I am really stunned that this previous CEO, Chen Lihui, is still conducting business and making deals with his newly formed company. Don't they have laws in china to bring such errant executives to task?

Currently, their new CEO, Dr Pu Weidong, is also one of the biggest shareholder through his investment holding company (Triumpus Capital). So I guess he is trying his very best not to let this investment be a total write off for himself. Their current chairman, Wang Sen, is just 38 years of age which the other directors highlighted that he has the right connections to get things done in China. When i try to google about the companies he is involved in, I don't seem to find anything hmmmm.

With the restated accounts after taking into consideration of the account irregularities, they are making losses for 2010 and heavier losses in 2011. The audited 2012 results will be out by October 2013. Current NAV stands at around 0.12 Sgd from the previous 0.5 Sgd. Ouch!

For those who are interested in the numbers, you can check out their annual reports and learn a lesson or two from "creative accounting": http://www.sgx.com/wps/portal/sgxweb/home/company_disclosure/annual_financial

The current directors plan is to stabilise the ship which should take at least a year and once things are back to normal, they will re-list the company. I certainly hope they are able to do so but chances are slim till I could see they are starting to turn in profits.

I would also like to highlight that that they have actually proposed an increase in director fees by almost one fold from 100k plus to 200k plus giving the reasons that there are more directors and the transition phase is tedious and time consuming for the directors. Really BS!

Nonetheless, I wish Dr Pu and his team all the best in turning over this company.

Lee

Thursday, 1 August 2013

Art of the Trade

This is a reprint of "Dancing with Lions" where the author was using an anonymous identity then in 1999. Basically, this book is more on the storytelling rather than teaching you how to trade. I believe the author is coming out of his anonymous identity because he is currently giving seminars to teach people how to trade :).

This is an interesting read if you do not have much expectation as it depicts the life of a commodity broker which is something out of the movie "Boiler Room". It reminds me of the days of the "White House" in Tanjong Pager where all the bucket shops are located. They will entice people to go for their career talks which promised high hourly pay. Their main motive was of course to persuade you to invest so that they can churn you till you are totally depleted. I have been through the career talk but have never invest as how much can a student looking for a holiday job have?

The book does touched on the emotional side of trading as in how to handle losses and the common risk management concept. Overall, it is not spectacular but could be a book you could bring to a holiday trip. You could finish the book in one to two seating.

Lee

PRIMARY ONE REGISTRATION (UPDATE)

This is an update of the primary one registration status which I have written earlier here. We are so glad that we have managed to get in through Phase 2B without any ballot.

Based on historical records, this was a "given" situation especially if you are staying within 1 km. However, this year the competition is intense and we almost have to go into ballot till someone finally withdraw at the last minute. Thou even if there is a ballot, the probability would be really high but we could end up being the few unlucky ones and we have totally no backup plans. Going into Phase 2C would be really competitive, we are looking at a 2 for 1 situation.

The wait for the result was quite nerve whacking as some of my grassroots friends can't even sleep or even have to take fever medicine during the course of the process. Therefore, we can empathise with those currently waiting for the results for phase 2C and we wish you could be as fortunate as us not to go through the ballot process. Even if there is a ballot, we wish you lots of luck.

We are just thankful that our efforts have been rewarded.

Lee

Subscribe to:

Comments (Atom)