Contributed By: The Big Fat Whale

We touched on Silver as one of the first few articles on this website in March 2021. After the article, it has been range bound between $18-$25. In recent times the price action looks great for a potential breakthrough of their key resistance at $30,

Hence, we decided to revisit our thesis and see if everything still firmed up nicely.

Technical Analysis of Silver

Source: TradingView

The peak of Silver at close to $50 was established during the Hunt Brothers' short squeeze in 1980 and 2011. The price of silver is still far off the peak and Gold has already broken its all-time high- trading at around $2400 now.

Source: TradingView

Zooming in on the charts, this is the fourth time that SIlver has tested the $30 mark since 2020. We could see volume has been higher over the past year as compared to the other periods. This could be a sign of accumulation.

So realistically, if there is a convincing break above $30, Silver at $50 as a target over the medium term would not be far-fetched.

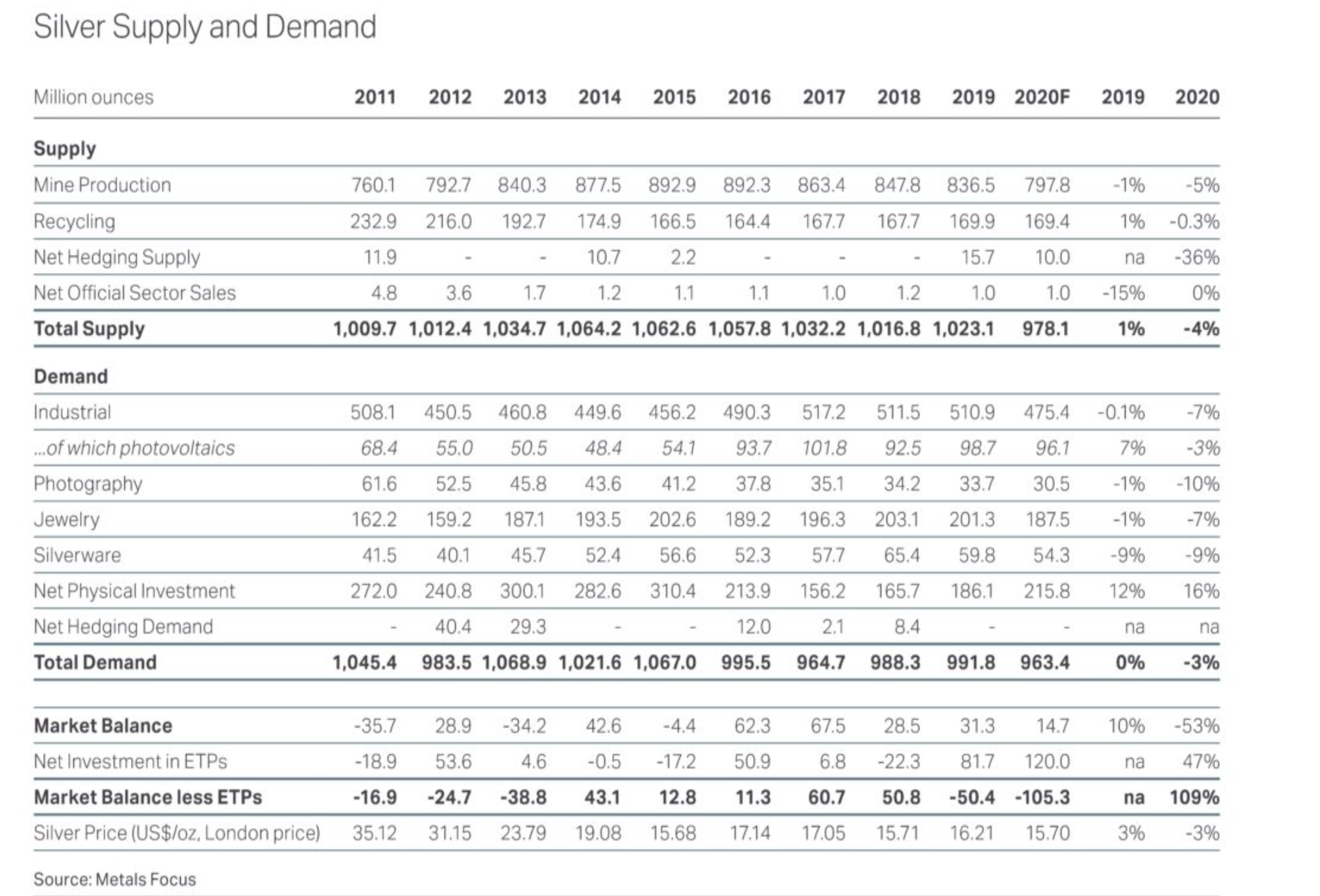

We will be looking at the fundamental aspects to see if it could support such a move.

Click Here for the Full Article:

https://thebigfatwhale.com/is-silver-going-to-be-a-great-investment-50-target/