Contributed by: The Big Fat Whale

We have taken inspiration for my title to this post from the now trending Reddit community; where the short squeeze of GameStop was brilliantly done from the #wallstreetbets Reddit crowd. They also have a #wallstreetsilver Reddit forum which could be the next to go on a trending mode as a short squeeze was on the way recently but it halted at the critical 30 dollars level.

This post will be touching more on the fundamentals of silver rather than just pure speculation and hoping for a parabolic surge based on a short squeeze. A comparison of a short squeeze on SLV (the largest silver ETF) as compared to GameStop seems not logical: SLV short interest is just around 8% versus over 100% when Reddit traders were squeezing the hell out of the short-sellers.

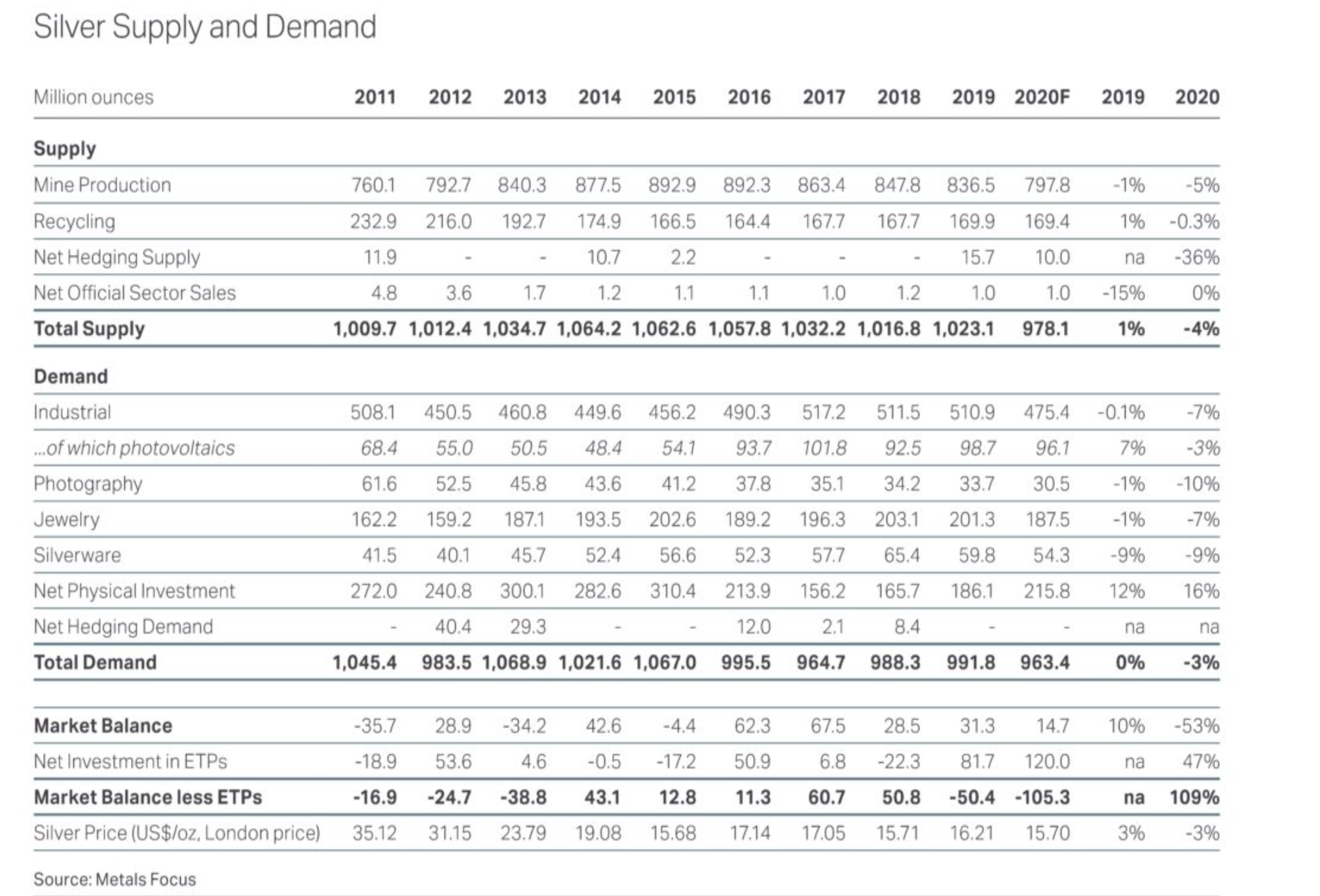

What is the attractiveness of silver as an investment then? The simple answer to this question will be supply and demand. Currently, the supply and demand numbers are at around 1 billion ounces per year and so there is not much excess supply to go around.

Industrial Use

Silver demand as compared to Gold is multi-faceted: there are lots of uses for silver in the industrial space and gold is mainly used as a store of value. More than half of the 1 billion ounces per year are set aside for industrial use. Silver is used in many sunrise sectors such as solar, electric vehicles, medical, dentistry and others. The demand for industrial use would only accelerate in the future based on the uprising sectors such as solar and electrical vehicles.

Half of the remaining supply (250 ounces) would be used for investment purposes such as ETFs and physical silver. The other half will be for jewellery and silverware.

Here is the link to the full article:

https://thebigfatwhale.com/silver-to-the-moon/