Contributed By: The Big Fat Whale

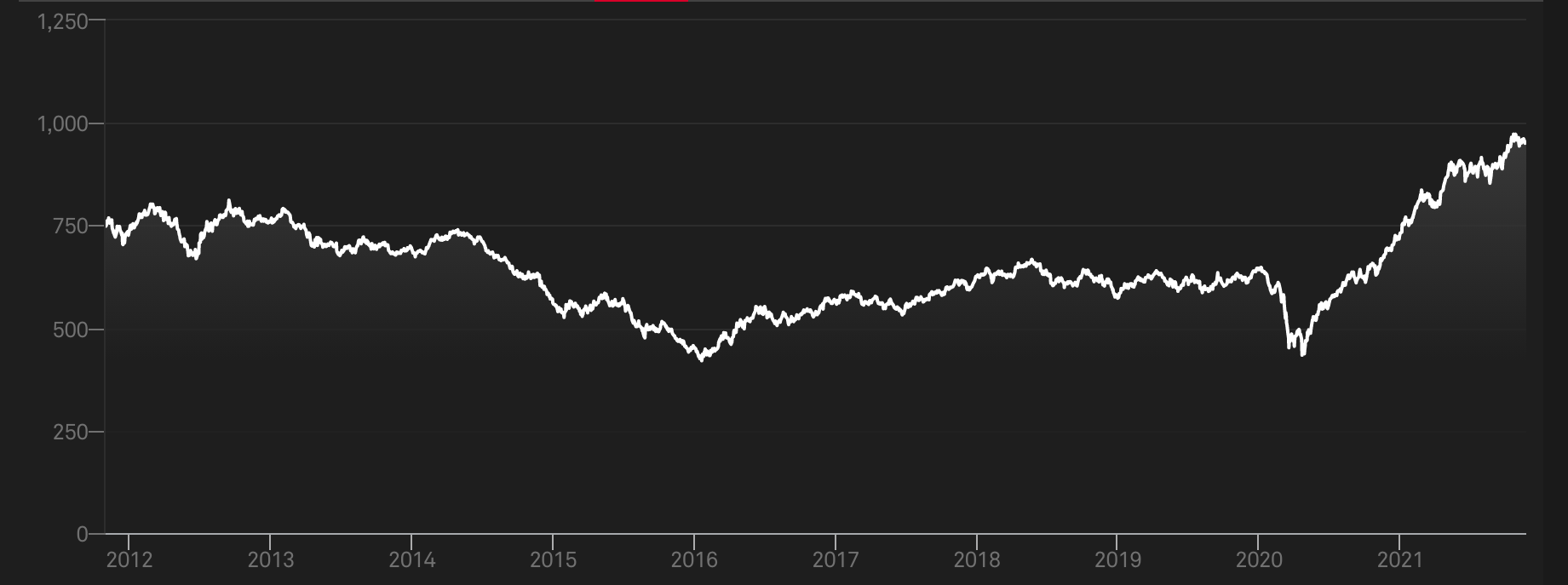

Despite 3 offers for Paramount Holdings, the stock has been languishing. This is one of the holdings of Buffett’s Berkshire Hathaway.

We have touched on Paramount in our previous write-up, where we think that it is worth being on your shortlist due to its valuation. Truth be told, there are now 3 offers tabled for Paramount after our article. We would like to think that is where great minds think alike.

3 Offers for Paramount Holdings

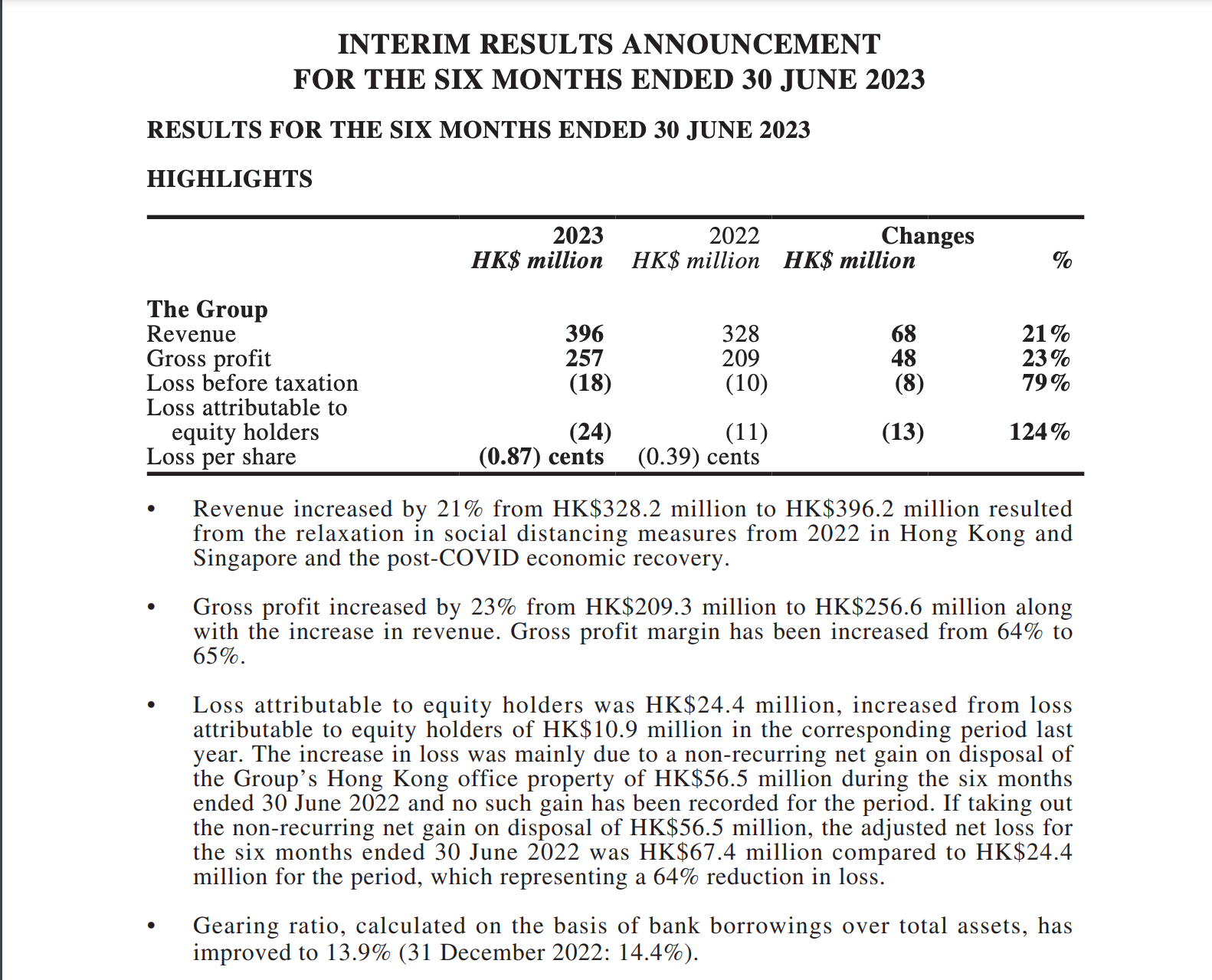

First and foremost, at the current price of 11 dollars, it has a market capitalisation of 7 billion dollars.

It has total debt of close to 15 billion dollars with 2.5 billion dollars in cash.

Skydance Offer

Skydance is led by David Ellison who is the son of Larry Ellison.

Their initial involvement was by trying to acquire National Amusement which owns 77% voting class stock.

This latest offer seems to be taken most seriously as they are currently in an exclusive discussion. Based on the grapevine, it could very well be a merger with an eventual cash infusion by Skydance to bolster the financials to deal with the debt situation ( Paramount debt was recently downgraded to junk status by S&P) based on a Reuters newsflow.

The deal seems more complex with Paramount raising funds to the tune of 3 billion dollars to facilitate this whole transaction. This sounds more like equity fundraising which could lead to a dilution of existing shareholders. Paramount would be the party to initiate the first move by taking over Skydance.

For this deal, the stock is to be continually listed and things would be back to normal with the majority of their assets intact.

There would likely not be a windfall for shareholders through a buyout offer with this deal.

Skydance will try to nurse Paramount’s business back to its glory days. They could be the right partner as they have been collaborating with Paramount from 2009 to 2021.

We can see why this is the preferred deal as Paramount assets are currently depressed. To sell off the assets in such a situation would be less optimal.

Moreover, their debt woes would also affect their negotiation chips.

Click Here for the Full Article:

https://thebigfatwhale.com/buffetts-paramount-stock-holding-languishing-despite-3-offers/