There seems to be no safe haven in this current economic landscape with runaway inflation and plunging stock prices. Gold could be one asset class to look at and digital gold- Bitcoin- seems more attuned as a speculative venture that mirrors the drop with the once-mighty growth stocks.

Despite the challenging environment, we feel that these 2 stocks should hold well and even be a beneficiary of the current woes. All of us know the prices of oil and the prices of cars in Singapore's case are shooting up. The certificate of entitlement for a car is reaching almost 72k USD in Singapore and that is even before the cost of the car is factored in. In this double whammy scenario, many could be turning to public transport.

In a discussion with a friend, he suggested for those who are used to a car, would rather dine out less so as to enjoy the convenience of having a car. So we have different sides to the notion of the shift towards public transport. If prices remain sky-high, we believe our thesis could be the more likely scenario.

Moreover, the prices of cabs have also been rising in tandem with inflation. Nowadays, it seems hard to flag a cab and they are usually available only through the different booking platforms. A normal trip could easily top $20 nowadays where it could be in the mid-teens previously.

What are the 2 Stocks?

So today we are covering 2 stocks namely, Transport International and SBS Transit. They are looking attractive given the tailwinds towards their business in this current inflationary situation. It is not only recession-proof but an essential industry.

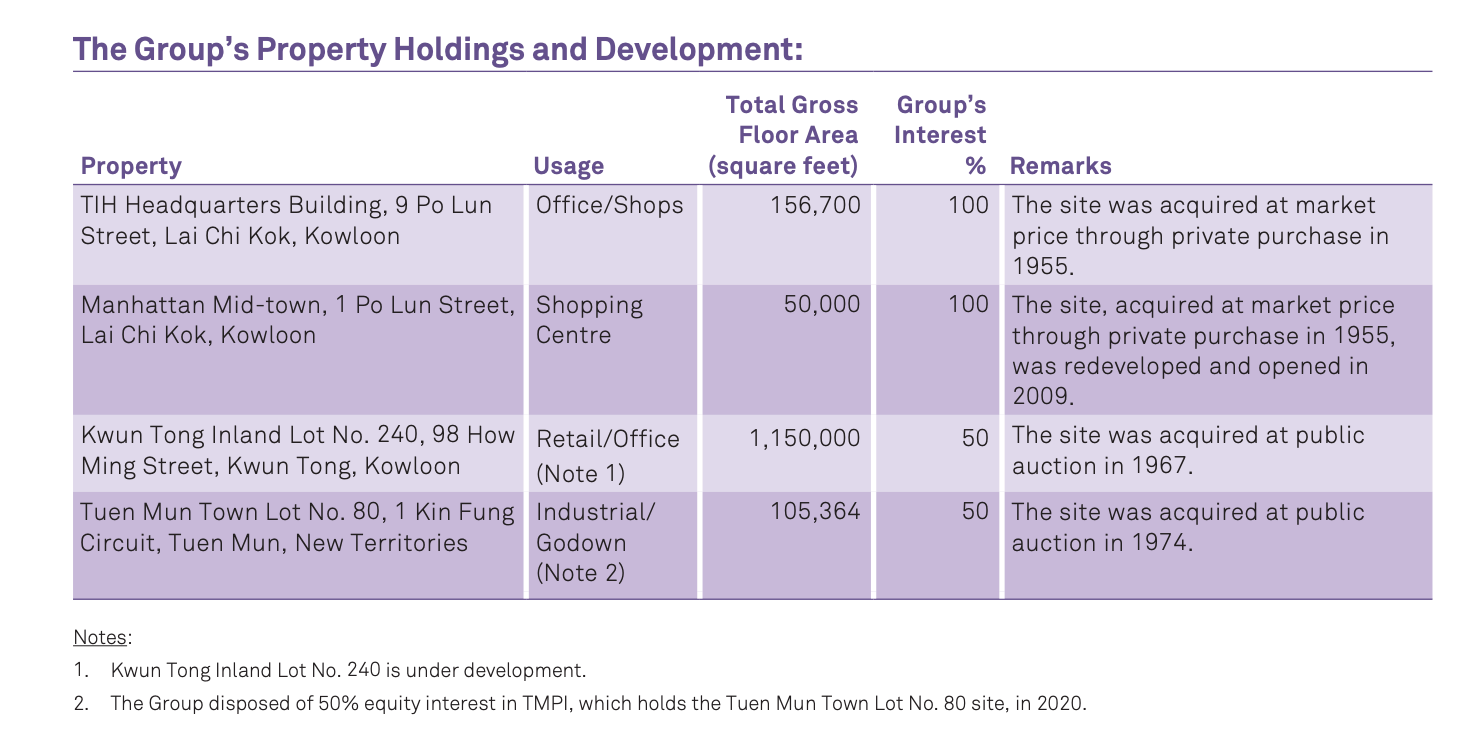

Just a brief overview of their business, both of them are in the transportation business mainly as a provider of public bus services. Transport International is also a property play (Investment Properties make up 35% of the book value- Leading Hong Kong Property Developer, Sun Hung Kai, has a 33% stake in TIH) whereas SBS Transit has the train and commercial segment (Advertisement and Rental of Shops in the Train Stations) from their managing of the North East and Downtown lines in the Singapore MRT network that have 6 lines.

Source: TIH Annual Report 2021- TIH's Property Holdings

Click Here for the Full Article:

No comments:

Post a Comment