Contributed by: The Big Fat Whale

- Propnex is trading at a PE of 11 and a dividend yield of 7.6%

- They have the largest amount of agents in Singapore

- Earnings have fallen by 18.8%

- Propnex Price has dropped 32% from their peak

- They have an impressive Return on Investment of 37%

Propnex has been a stock on our radar due to its great return on investment metric. Sadly, we have missed the good run that they had over the past 2 years. So with the recent correction in price, is it turning into a value play?

The stock market is a forward-looking proxy for the economy. Is the recent weakness in the price of Propnex an indication of a correction of Singapore Property Prices ahead?

We did an article on a likely property crisis in late 2022, and we still hold to the view that our thesis is valid.

We will dive into the different elements to hopefully unearth some useful insights. More importantly, we would like to know if Propnex at its current level is an investment worth considering.

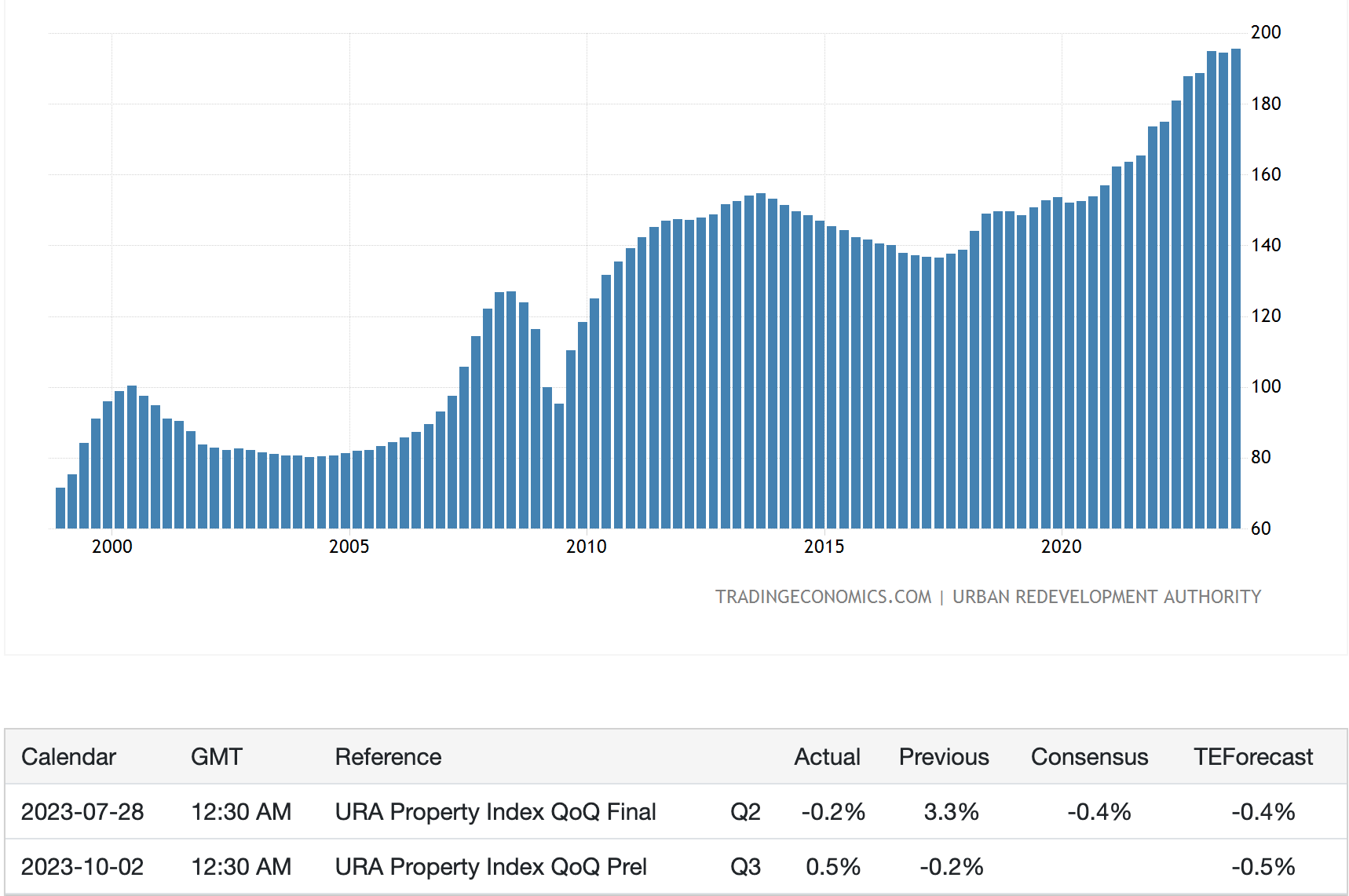

Property Price Trend- Singapore

Source: tradingeconomics.com

Let us first have a look at the property price trend in Singapore to have a better feel of the general direction. Looking at the URA Property Index which has done a coverage of private home prices, we are still seeing an uptick in the prices.

There was a slight decrease in 2023Q2 but for 2023Q3, the prices reverted back to their uptrend.

Looking through the charts from 2000, there were 3 evident corrections for the Singapore Property Market. They are in the early 2000s (9/11 and Sars), 2008 (Global Financial Crisis) and 2014 (Euro Crisis).

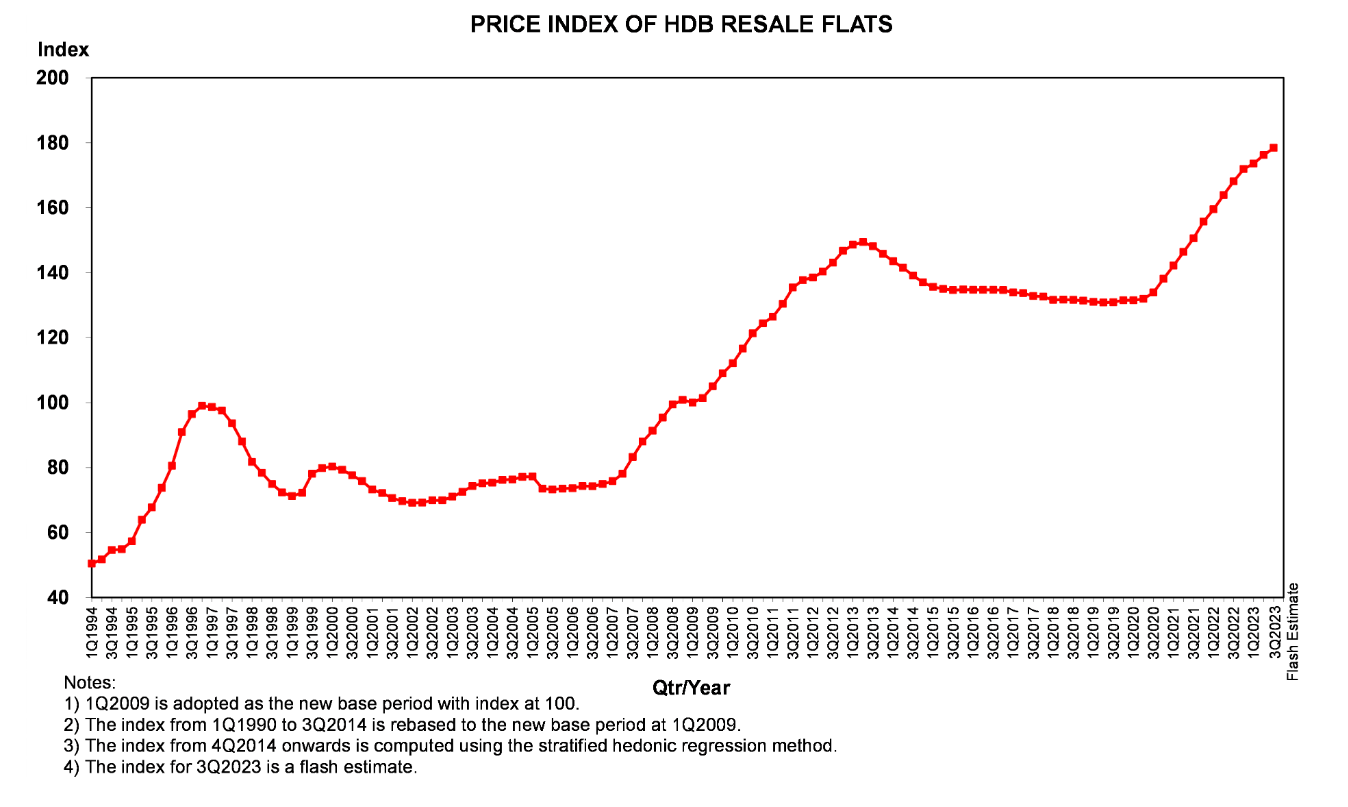

Source: HDB

The HDB (Public Housing) Price Index is showing an even stronger upward trajectory. There was no drop in prices for 2023Q2.

In essence, Singapore property prices are still in unchartered territories by reaching new highs. Even with the upsurge in interest rates, the government's restrictive policies (literally at 60% taxes for foreigners to buy a property- it has killed the interest of this segment), and big tech layoffs, the property market has remained resilient.

Click here for the Full Article:

https://thebigfatwhale.com/propnex-value-property-prices/