Contributed By: The Big Fat Whale

The digital payment industry has been on a steady climb for many years given the e-commerce revolution. The Covid 19 situation, has further led to new users who usually would not have shopped online to come onboard. All these bode well for a good runway for further consistent growth ahead.

With the coming of the new era of Metaverse by Meta, where the future could be split between your virtual and physical world, the need for a digital wallet would be essential. The digital wallet could be used for keeping your digital currency, digital assets (NFTs) and other digital-related items.

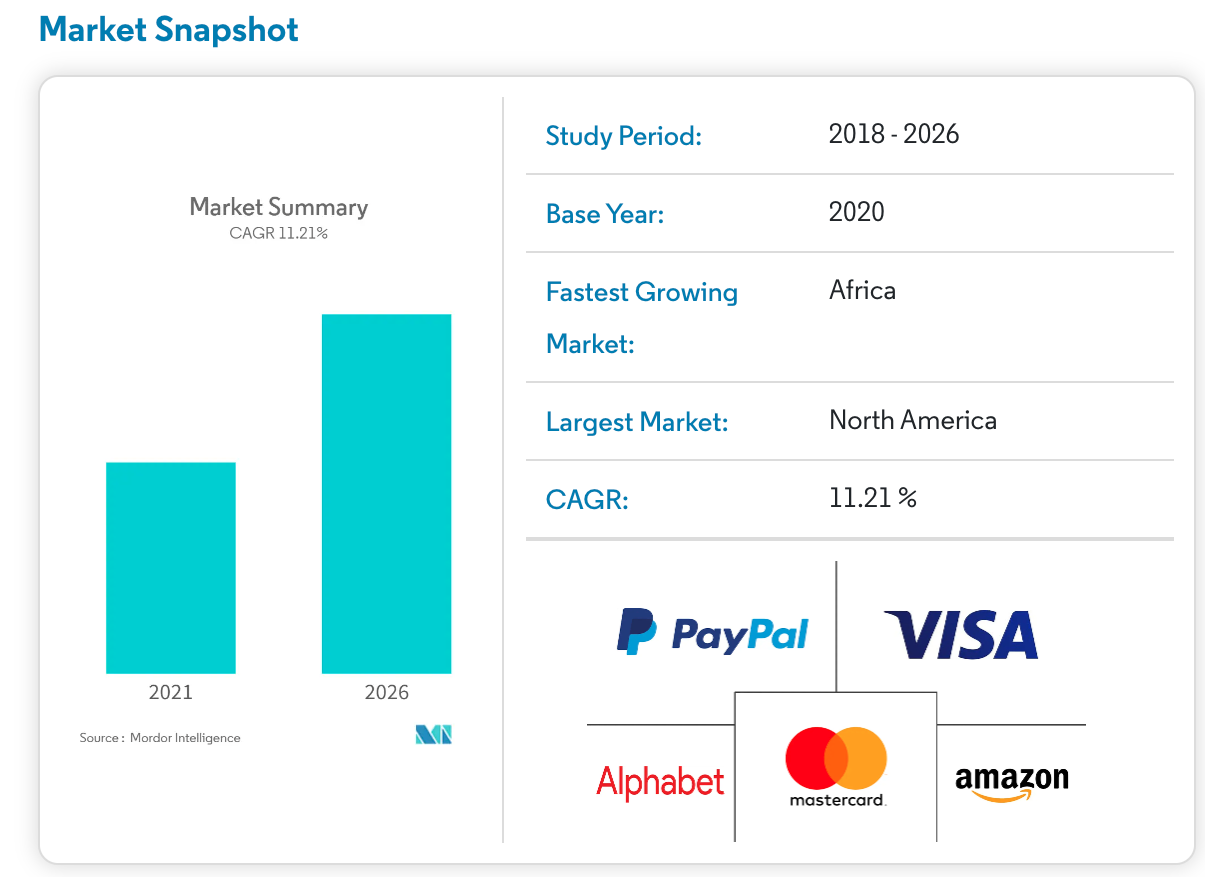

Source: Mordor Intelligence

The transaction value of the digital payments market was USD 5.44 trillion in 2020, and it is projected to be worth USD 11.29 trillion by 2026, registering a CAGR of 11.21% from 2021 to 2026

Source: Mordor Intelligence

The global payments market is expected to grow from $466.29 billion in 2020 to $517.68 billion in 2021 at a compound annual growth rate (CAGR) of 11%. The market is expected to reach $735.39 billion in 2025 at a CAGR of 9.2%.

Source: Businesswire.com

The growth as predicted by both Modor Intelligence and Businesswire for the digital payment industry would be in the region of around 11% for the next 5 years. This is consistent growth rather than exceptional growth but one thing is for sure, it is still a sunrise sector. Hence, it is going to be a good place to look for potential investments.

Here is the full article on the Merits of Investing in PayPal:

https://thebigfatwhale.com/your-gateway-to-metaverse-paypal/