Contributed by: TheBigFatWhale

With the latest move by the Fed, where they are looking to have 3 interest rate hikes in 2022 and into reducing their balance sheet, growth stocks have not been faring well. The move by Fed is a move towards a monetary tightening policy that will drain the exodus of liquidity that has been pumped into the economy since early 2020.

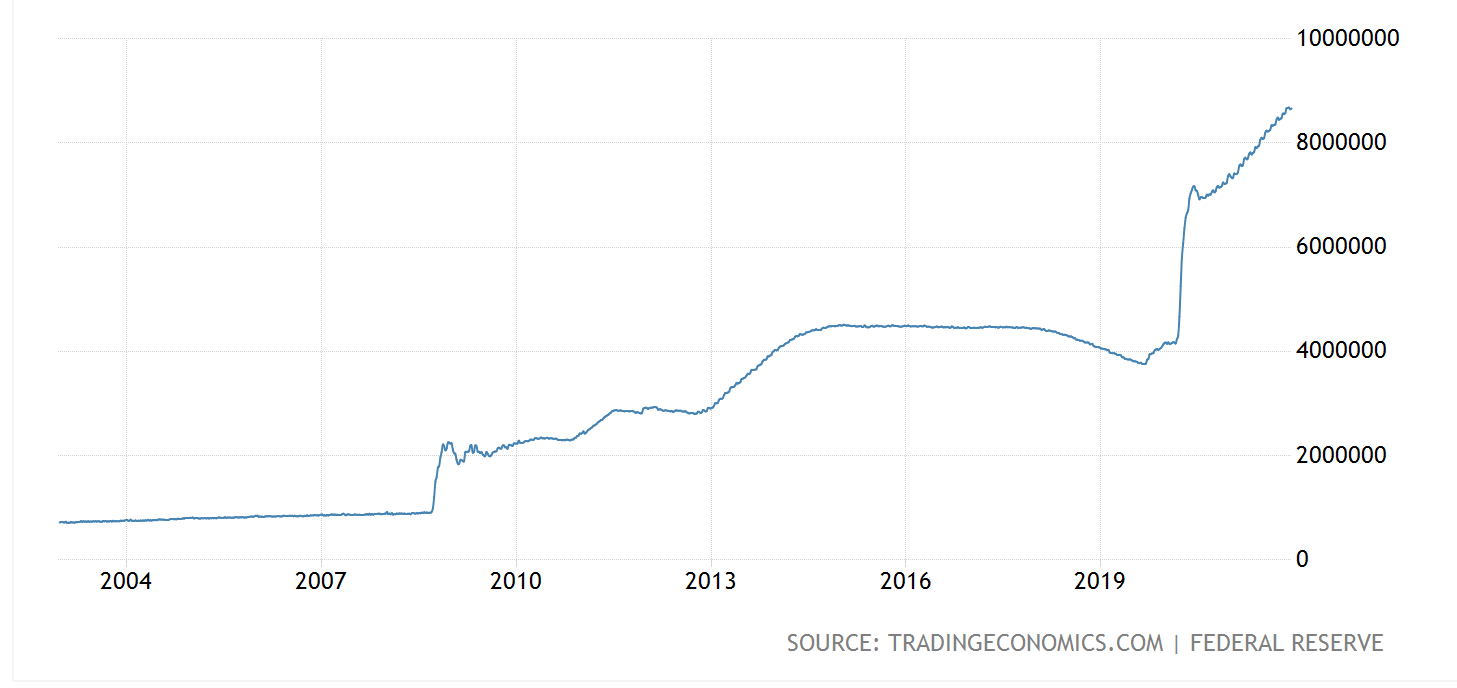

Source: Tradingeconomics.com- Fed Balance Sheet

The Fed Balance sheet has more than doubled since 2020 which is a worrying sign that things are going out of control. Therefore, the indication by Fed to reduce their balance sheet is a sound and prudent move provided they are really serious about doing it. We touch on our previous article about the 6 indicators to gauge if the S&P 500 is peaking with the Fed Balance sheet as one of our concerns.

With a potential stoppage of easy money, the prospects for growth stocks could be bleak. Most of the growth or innovation stocks run on the theory that they would be wildly profitable once they are able to scale. Moreover, it is the vision for the future and it will disrupt the whole way things are done.

Click Here to Read More:

https://thebigfatwhale.com/feds-latest-move-demise-of-arkk-and-innovation-stocks-quick-thoughts/

No comments:

Post a Comment