His bet was on the basis that the market has reached maximum pessimism. His good foresight has proven prescient and it netted him close to a 5 times returns when he eventually liquidated all of his positions years later.

The point we are trying to highlight is that the market tends to overreact and therefore, we do not feel Meta have reached the optimal entry-level despite the huge decline in recent times. The bearish trend might just have started and it would need some time to play out.

Let's first revisit some main points that led to Meta's plunge:

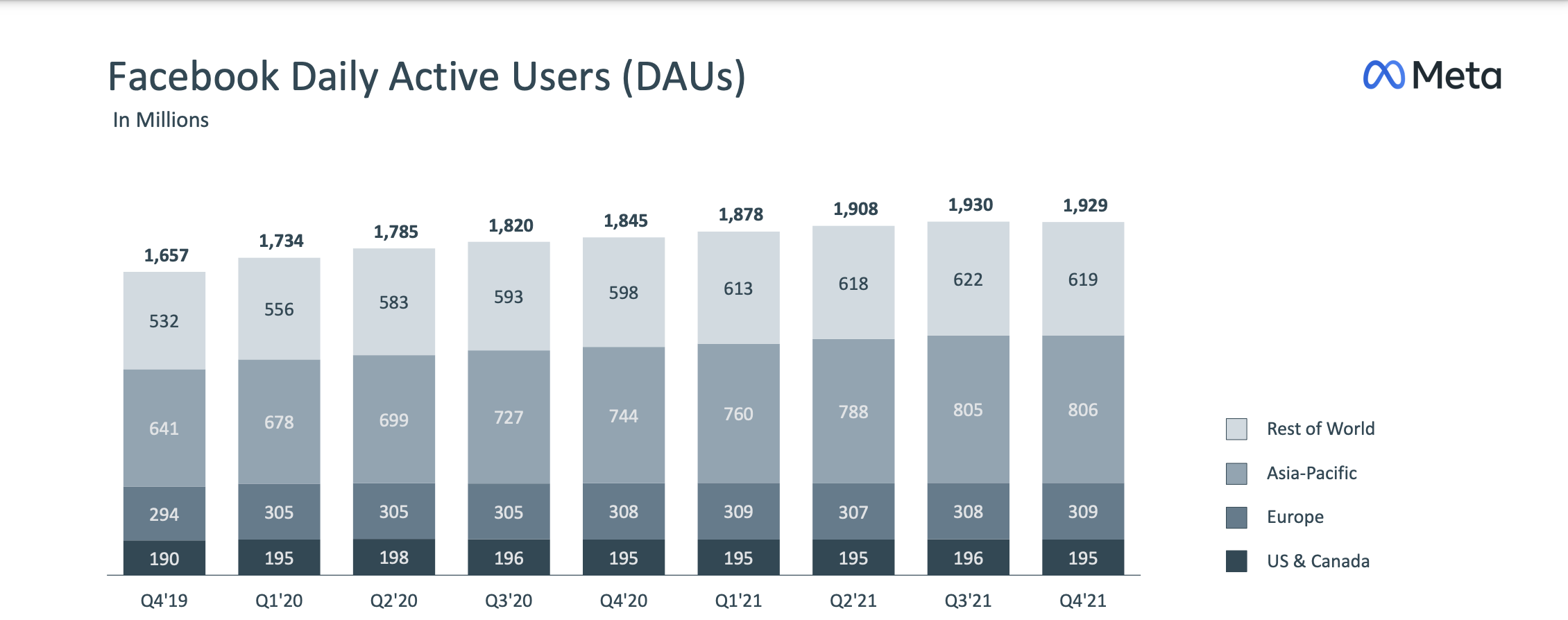

- The fall in Daily Average Users (DAUs) for Facebook- an important barometer of growth.

- Apple Privacy Policy would cost Meta 10 Billion a Year

- 10 Billion a year to be spent on research and development for MetaVerse

- Credible Competitor in Douyin (TikTok)

Source: Meta Corporate Presentation

Click Here for the Full Article:

https://thebigfatwhale.com/is-meta-a-buy-now-not-at-maximum-pessimism/

No comments:

Post a Comment