Contributed by: The Big Fat Whale

If the financial markets have a crystal ball, it would be everyone's dream to grab hold of it.

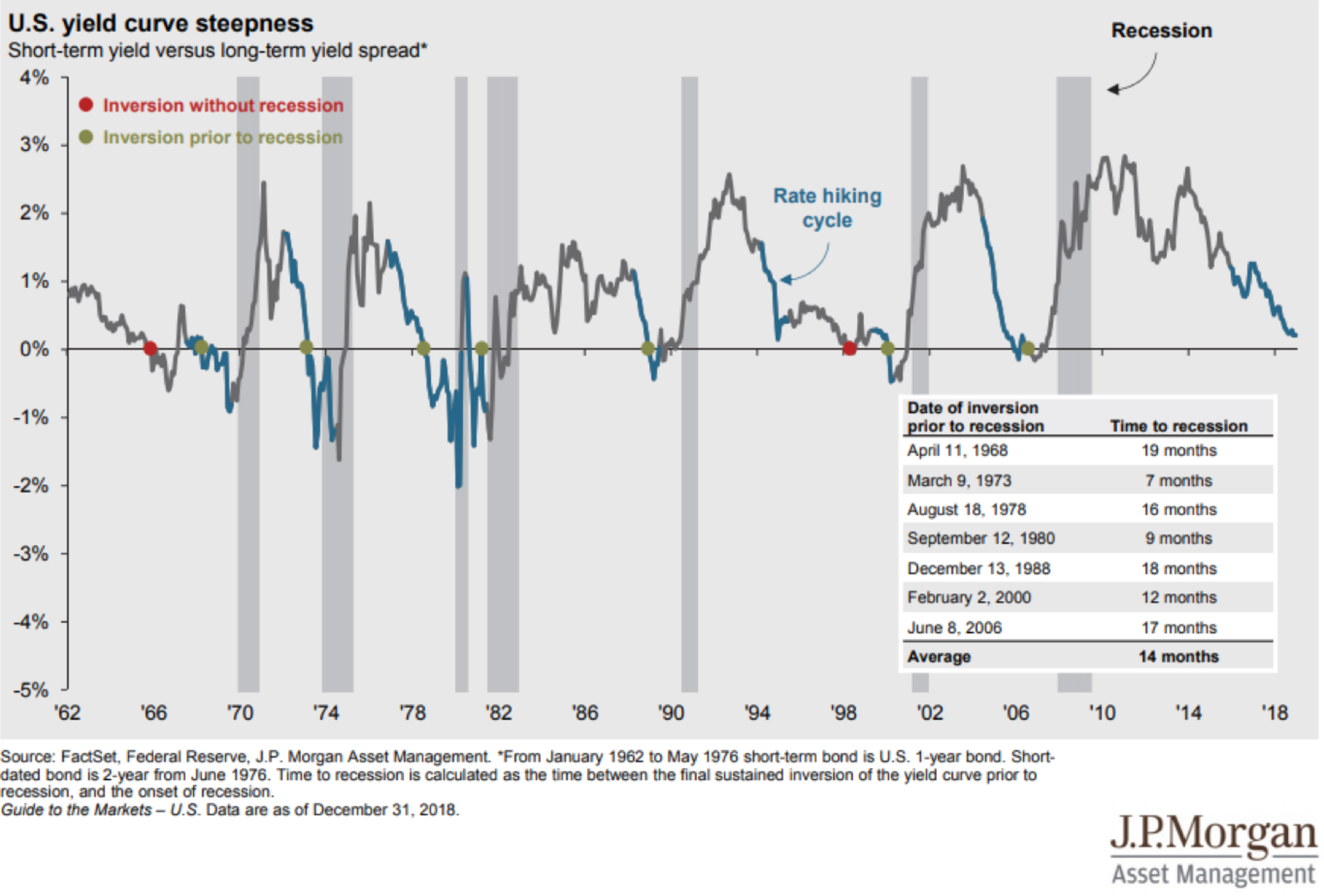

Today, we are going to share with you, an indicator that has successfully preceded a recession since 1955 except for once in the mid-1960s. There was an economic slowdown rather than a recession but the forecasting prowess should not be undermined.

Uncannily, the latest inversion was in 2019 that preceded the market crash caused by Covid 19 in March 2020.

Source: JP Morgan Asset Management - For the 2020 recession in April, it took 8 months to recession after the inversion.

On April 1st 2022, the 2 years and 10 years of US Treasuries rate saw an inversion again. It would be foolish to ignore it given their track record of predicting a recession and economic slowdown.

Click Here for the Full Article:

https://thebigfatwhale.com/recession-oncoming-forecasted-by-the-inverted-yield-curve/