Contributed By: The Big Fat Whale

Alaska payout is around $1000-$2000 per year to all citizens since 1982. The amount depends on the oil revenues of their state-owned investment fund. However, the population of Alaska is just 730,000 people which makes financing it more manageable.

As for Iran, there is a population of 84 million people, the universal basic income has been implemented since 2011. The amount equates to US$40 per person per month which sums up to US$480 per year.

Why the need for a UBI?

In an ideal world, everyone could be doing the things they love and yet not worry about finances with UBI. In this type of utopian environment, there could be an abundance of wealth as wealth should be measured not only by how much you have in your bank.

More importantly- your mental state, health, family bonding and living environment.

However, to accomplish this, it is an uphill task for any government. The funding of UBI would be a real nutcracker for governments to balance their budget and yet implement this scheme.

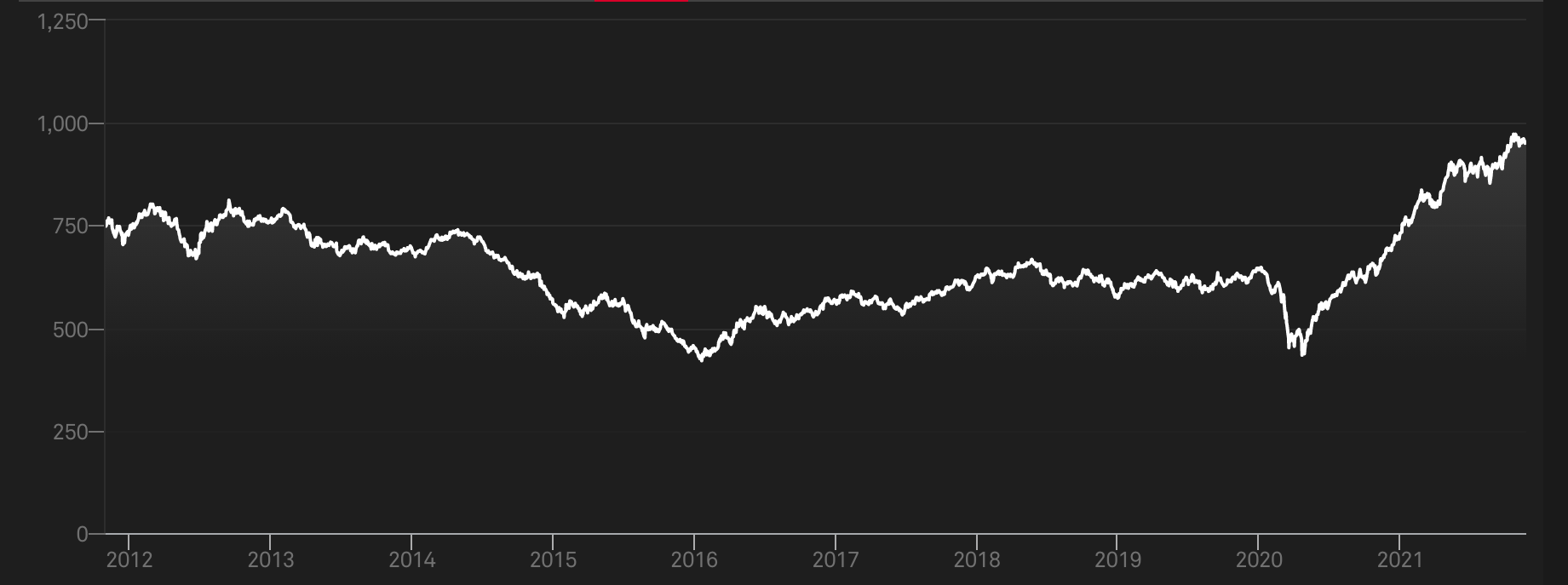

Looking at around the world now, with massive technological advancements through Artificial Intelligence and ever-increasing wealth disparity between the top 10% and the rest of the population, the call for a serious look into UBI should not be undermined.

Here is the link for the full article:

https://thebigfatwhale.com/is-basic-universal-income-viable-in-singapore-2/