Recently, during the usual social media binge, I chanced upon a sponsored video that featured a loser. He is working as a clerk and have no girlfriends in his life and so on and so forth.

Miraculously, his life took a change for the better when he met a friend that introduce him to a jackpot scheme that earns him 1k a day. I am sure many of us will not fall prey to this potential scam as the warning signals are quite obvious.

Nonetheless, in recent times, scams or inflated investment schemes have been more elaborate and even a savvy well-educated individual could fall for it. I have just read this blog post where the author's dad lost almost 99.3% of his capital through land banking. We can definitely feel for him but the amount is still manageable, just imagine if he has sunk in his life savings. Here are just some scams or investment schemes through the years.

Help me get funds out and you get millions

Imagine back in those days, there were "Nigerian emails" schemes, where a government official from some African countries is getting a huge sum of funds out of their country. They would just need your help and you could get millions as a cut. The critical point is that you have to pay some transactional fees for their bank to remit the money out. Sounds familiar...

Lehman Bonds

I guess the most elaborated investment scheme that caused lots of damage would be the Lehman bonds that just yield 5%. I would deem it as a scheme as there is really underlying value in the form of housing mortgages.

It was also structured by renowned banks with renowned counterparties and distributed and sold by the banks. Given the yield, we would deem it as a safe instrument and the marketing as Lehman bonds further mislead us as bonds issued by Lehman Brothers that have a great credit rating at that point in time.

To be frank, not many would take the time to read through the thick and boring prospectus and will take the bankers word at it. Even if the bankers have your best interest, I believe it might not be easy for them to decipher the risk to it given all the jargon- they ain't Michael Bury.

Moreover, the rating agency has given AAA rating to the instrument.

Glasgow Airport Carparks and UK Hostels

The Glasgow Airport Carpark scam looks really legit and was marketed as approved by the UK pension funds. It gives a yield of around 11% which is really attractive. Apparently, the company behind the scheme do not own the car park at all. The minimum quantum is at 25k pounds

There were also lots of UK hostels and hotels being pitched at an 8% yield. A friend of mine got into it in a pretty big way accumulating a portfolio of these hostels and hotels for yield. On the whole, it was ok but there were a couple that didn't manage to fulfil their obligations and the owners took over the properties. Instead of 8%, they were lucky to be getting just 1%-2%.

I think the bottom line will be to do due diligence on the underlying companies behind the project cause if they default, we will be in tears.

Recent Episodes

The most recent schemes have involved even bigger amounts with the most notable being The Envy group. More than 1 billion was involved and most of the victims are sophisticated and savvy individual and institutional investors. It way surpasses the 190 million Ponzi scam of the Sunshine empire that targeted heart-landers.

Also, even SMS from the banks, we have to be sceptical as recent phishing via SMS scam impersonating OCBC bank have seen almost 5 million dollars being lost.

In a nutshell

It is really an environment that we have to be more vigilant in order to safeguard our hard-earned savings. The schemes and scams have become more sophisticated where even the well heeded would fall prey to.

We just hope more targeted public education would reduce the probability of more people being victimised.

Our blog would do our part by highlighting investment schemes that we feel is worth more due diligence whenever we come across any.

On a parting note, we would advise everyone should do more research when investing in an instrument or plan, just as if you are buying a car or a house.

Disclaimer:

The information contained in this publication is provided to you for general information only and is not intended to nor will it create/induce the creation of any binding legal relations. The information or opinions provided do not constitute investment advice, a recommendation, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person or group of persons acting on this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise.

You may wish to obtain advice from a financial adviser before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest.

Any views, opinions, references or other statements or facts provided in this publication are personal views and shall disclaim any liability for damages resulting from errors and omissions contained.

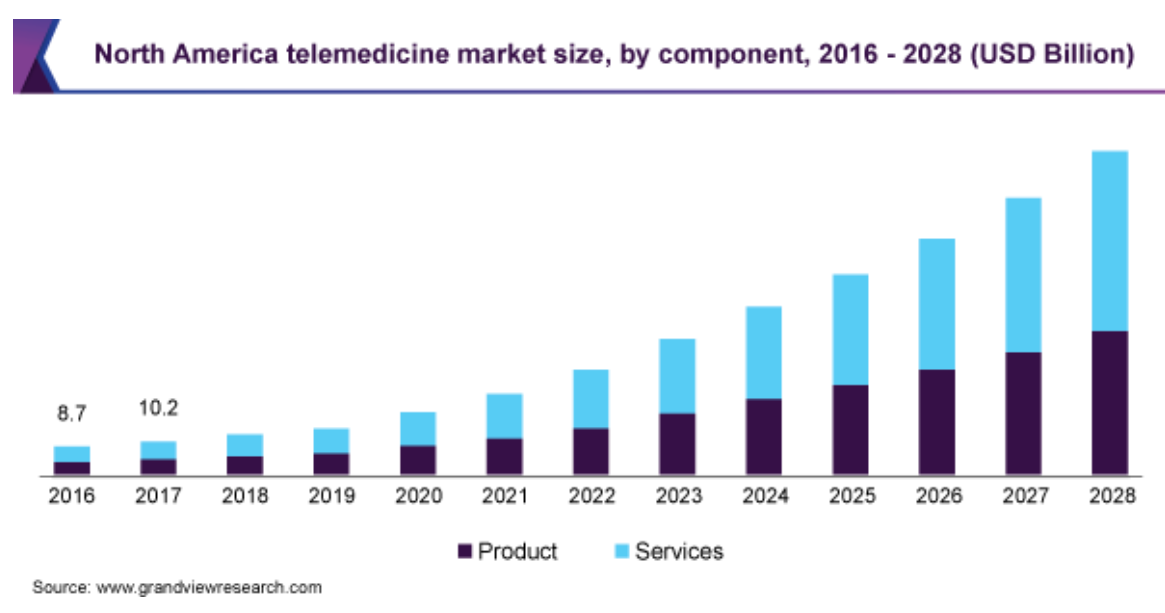

Source: www.grandviewresearch.com

Source: www.grandviewresearch.com