Thursday, 20 January 2022

Off Grid Living on $10 per year in Northern Thailand- Retirement Plan

Monday, 10 January 2022

Food Economics: Char Kway Teow better than Zion Road Version

With costs escalating through the years and into the future, hawker food culture will be an essential part of our food economics to balance out our finances. I guess many will agree with me that it is more economical to buy out in a food stall than cook in if it is just for yourself or a couple.

There will be a compromise in terms of a healthy diet as take-away from food stalls are usually more greasy and laden with msg. Nonetheless, we could choose healthier options and make it part of our overall budget to make FIRE viable.

So it leads to this post that will come under my food economics series, where I try to highlight good foods at a reasonable cost which is similar to growth at a reasonable price in stocks analysis.

During New Year day, I went to try the Zion Road Char Kway Teow based on the Instagram post by Lady Iron Chef and many have also deemed it as one of the best.

I just find it too greasy and overhyped- it was not the first time I have tried it but taken in by the marketing hype and long queues yet again.

I am not sure if many would know it, at just a stone throw from the Zion Road food centre, there is a Havelock Food Centre that has lots of hidden gems tucked away in an old estate with nice greenery en route to it.

So this Char Kway Teow stall, Meng Kee Fried Char Kway Teow, I find it personally much better than the Zion Road version. It is less greasy and overall scores higher in my humble opinion. I leave the in-depth review to the expert which is Daniel from Daniel Food Diary. Here is his review. If you want the healthiest version of Char Kway Teow, head out to golden mile food centre where it comes in with lots of greens.

There are also some notable stalls which I will recommend as I have tried them personally. We have the white bee hoon stall, the turtle and frog-leg soup stall- highly recommended, Nasi Lemak stall- the drumstick is to die for, Kway Chap stall and Tan's Tutu.

I find the laksa stall to be overhyped. The chicken rice stall is previously from Margaret Drive. Lastly, the fish soup stall at the tail end always have a good queue but I have not tried it before.

Hope everyone will enjoy your food hunt at Havelock Food Centre. Most stalls are open till 2 pm so try to check it out during your lunch hour.

Saturday, 8 January 2022

Silver To The Moon?

Contributed by: The Big Fat Whale

We have taken inspiration for my title to this post from the now trending Reddit community; where the short squeeze of GameStop was brilliantly done from the #wallstreetbets Reddit crowd. They also have a #wallstreetsilver Reddit forum which could be the next to go on a trending mode as a short squeeze was on the way recently but it halted at the critical 30 dollars level.

This post will be touching more on the fundamentals of silver rather than just pure speculation and hoping for a parabolic surge based on a short squeeze. A comparison of a short squeeze on SLV (the largest silver ETF) as compared to GameStop seems not logical: SLV short interest is just around 8% versus over 100% when Reddit traders were squeezing the hell out of the short-sellers.

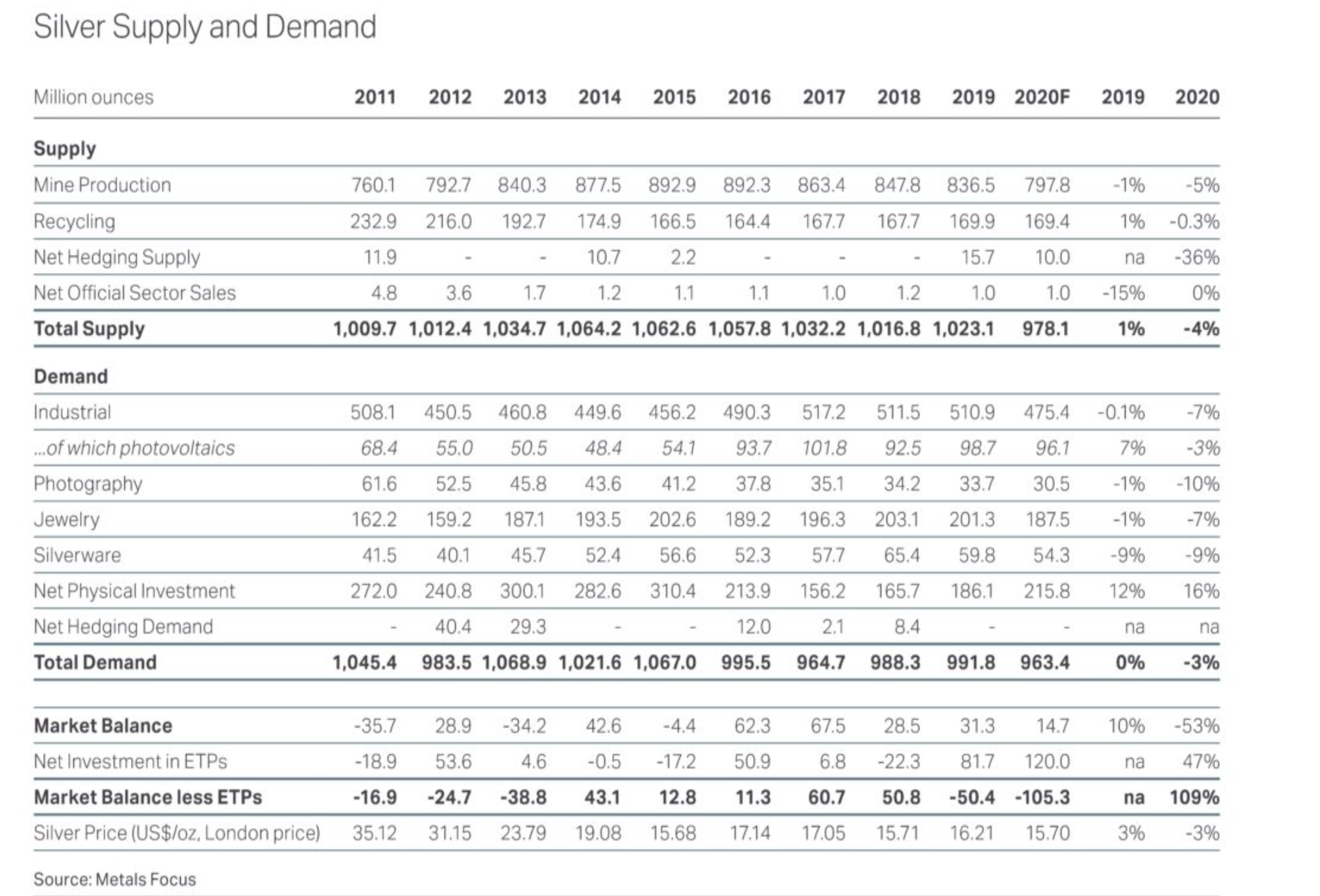

What is the attractiveness of silver as an investment then? The simple answer to this question will be supply and demand. Currently, the supply and demand numbers are at around 1 billion ounces per year and so there is not much excess supply to go around.

Industrial Use

Silver demand as compared to Gold is multi-faceted: there are lots of uses for silver in the industrial space and gold is mainly used as a store of value. More than half of the 1 billion ounces per year are set aside for industrial use. Silver is used in many sunrise sectors such as solar, electric vehicles, medical, dentistry and others. The demand for industrial use would only accelerate in the future based on the uprising sectors such as solar and electrical vehicles.

Half of the remaining supply (250 ounces) would be used for investment purposes such as ETFs and physical silver. The other half will be for jewellery and silverware.

Here is the link to the full article:

https://thebigfatwhale.com/silver-to-the-moon/

Thursday, 6 January 2022

Scams Aplenty- Beware!

Recently, during the usual social media binge, I chanced upon a sponsored video that featured a loser. He is working as a clerk and have no girlfriends in his life and so on and so forth.

Miraculously, his life took a change for the better when he met a friend that introduce him to a jackpot scheme that earns him 1k a day. I am sure many of us will not fall prey to this potential scam as the warning signals are quite obvious.

Nonetheless, in recent times, scams or inflated investment schemes have been more elaborate and even a savvy well-educated individual could fall for it. I have just read this blog post where the author's dad lost almost 99.3% of his capital through land banking. We can definitely feel for him but the amount is still manageable, just imagine if he has sunk in his life savings. Here are just some scams or investment schemes through the years.

Help me get funds out and you get millions

Imagine back in those days, there were "Nigerian emails" schemes, where a government official from some African countries is getting a huge sum of funds out of their country. They would just need your help and you could get millions as a cut. The critical point is that you have to pay some transactional fees for their bank to remit the money out. Sounds familiar...

Lehman Bonds

I guess the most elaborated investment scheme that caused lots of damage would be the Lehman bonds that just yield 5%. I would deem it as a scheme as there is really underlying value in the form of housing mortgages.

It was also structured by renowned banks with renowned counterparties and distributed and sold by the banks. Given the yield, we would deem it as a safe instrument and the marketing as Lehman bonds further mislead us as bonds issued by Lehman Brothers that have a great credit rating at that point in time.

To be frank, not many would take the time to read through the thick and boring prospectus and will take the bankers word at it. Even if the bankers have your best interest, I believe it might not be easy for them to decipher the risk to it given all the jargon- they ain't Michael Bury.

Moreover, the rating agency has given AAA rating to the instrument.

Glasgow Airport Carparks and UK Hostels

The Glasgow Airport Carpark scam looks really legit and was marketed as approved by the UK pension funds. It gives a yield of around 11% which is really attractive. Apparently, the company behind the scheme do not own the car park at all. The minimum quantum is at 25k pounds

There were also lots of UK hostels and hotels being pitched at an 8% yield. A friend of mine got into it in a pretty big way accumulating a portfolio of these hostels and hotels for yield. On the whole, it was ok but there were a couple that didn't manage to fulfil their obligations and the owners took over the properties. Instead of 8%, they were lucky to be getting just 1%-2%.

I think the bottom line will be to do due diligence on the underlying companies behind the project cause if they default, we will be in tears.

Recent Episodes

The most recent schemes have involved even bigger amounts with the most notable being The Envy group. More than 1 billion was involved and most of the victims are sophisticated and savvy individual and institutional investors. It way surpasses the 190 million Ponzi scam of the Sunshine empire that targeted heart-landers.

Also, even SMS from the banks, we have to be sceptical as recent phishing via SMS scam impersonating OCBC bank have seen almost 5 million dollars being lost.

In a nutshell

It is really an environment that we have to be more vigilant in order to safeguard our hard-earned savings. The schemes and scams have become more sophisticated where even the well heeded would fall prey to.

We just hope more targeted public education would reduce the probability of more people being victimised.

Our blog would do our part by highlighting investment schemes that we feel is worth more due diligence whenever we come across any.

On a parting note, we would advise everyone should do more research when investing in an instrument or plan, just as if you are buying a car or a house.

The Future of Medical Care- Teladoc

Contributed by: The Big Fat Whale

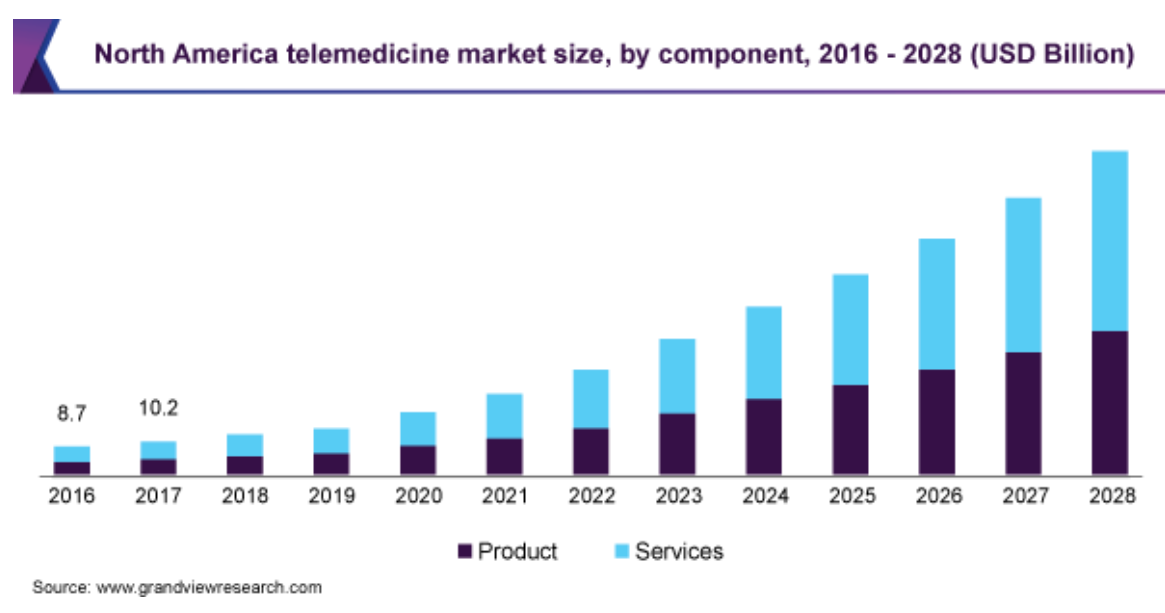

The telehealth market is one of the most glaring in terms of growth potential that surfaced during the recent pandemic. It is coming in from a low base initially and with Covid 19 in full force, it has triggered the adoption in huge strides. The regulatory issues were also quickly expedited for a smooth transition as quarantine became a norm for many.

Source: www.grandviewresearch.com

Source: www.grandviewresearch.com

From the estimates by Grandview Research, the total market potential could reach 300 billion dollars in 2028, which gives us a compounded return of 22.4%- it is a good run-way of consistent and viable growth. That is just the North American region.

These estimates are also backed by Mckinsey forecast for a 250 billion dollars telehealth market- a 20% share of the total medical market.

Strong continued uptake, favourable consumer perception, and tangible investment into this space are all contributing to the continued growth of telehealth in 2021. New analysis indicates telehealth use has increased 38X from the pre-COVID-19 baseline.

Source: Mckinsey

Here is the link to the full article:

https://thebigfatwhale.com/the-future-of-medical-care-teladoc/