Contributed By: The Big Fat Whale

Just as Marilyn Monroe famously declared, "Diamonds are a Girl's Best Friend", her song was released in 1953.

Since then, there are now a few more additions to the best friends list, namely the luxury bags. We are not too well versed but based on our research, the few that would add a smile to a girl if they are able to add to their collection would be top of the list, Hermes, followed by Chanel, Christian Dior and Gucci.

We are going to analyse 3 companies that never have a price discount and are able to hike prices consistently, yet there is great demand for their products. The 3 companies we will be touching on would be Hermes, LVMH and Christian Dior. Chanel would be a good candidate but unfortunately, they are privately owned.

For Hemes, they have positioned themselves nicely as it is almost impossible to get a Birkin bag if you walk into their stores. Most have to get it from the secondary market.

Source: Seeking Alpha

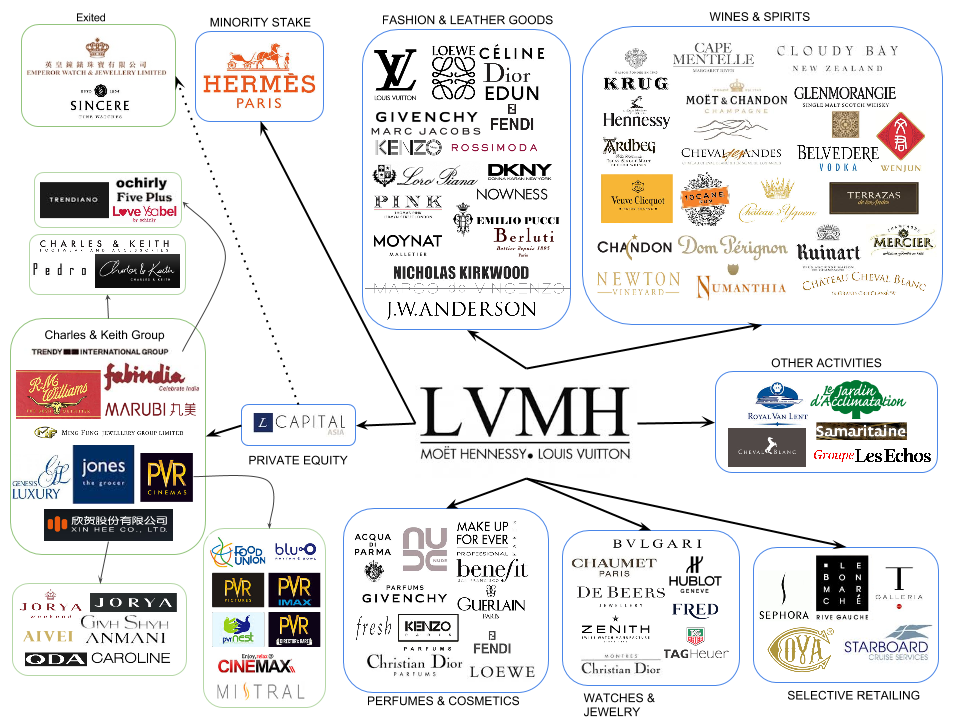

Of the 3 brands, LVMH is the most complicated in terms of ownership structure as could be seen from the diagram above. They have a minority stake in Hermes and a majority stake in Dior.

Luxury Goods Outlook

The growth outlook for the luxury goods market would be likely in the single digits of 6%-8% and could reach EUR360- EUR380 billion by 2025 based on the forecast of Bain and Company.

The revived luxury market has been powered by the resumption of local consumption, the dual engine of China and the US and the consistent strength of the online channel. Younger customers (Gen Y and Gen Z) continue to drive growth and together are set to make up 70% of the market by 2025.

Source: Bain and Company

Click Here for the Full Article:

https://thebigfatwhale.com/investing-in-womens-best-friends-luxury-bag-brands/