Monday, 14 February 2022

No Cash, No Bonds, Good Geographical Diversification for the New Norm- Ray Dalio

Sunday, 13 February 2022

Investing In Women's Best Friends- Luxury Bag Brands

Contributed By: The Big Fat Whale

Just as Marilyn Monroe famously declared, "Diamonds are a Girl's Best Friend", her song was released in 1953.

Since then, there are now a few more additions to the best friends list, namely the luxury bags. We are not too well versed but based on our research, the few that would add a smile to a girl if they are able to add to their collection would be top of the list, Hermes, followed by Chanel, Christian Dior and Gucci.

We are going to analyse 3 companies that never have a price discount and are able to hike prices consistently, yet there is great demand for their products. The 3 companies we will be touching on would be Hermes, LVMH and Christian Dior. Chanel would be a good candidate but unfortunately, they are privately owned.

For Hemes, they have positioned themselves nicely as it is almost impossible to get a Birkin bag if you walk into their stores. Most have to get it from the secondary market.

Source: Seeking Alpha

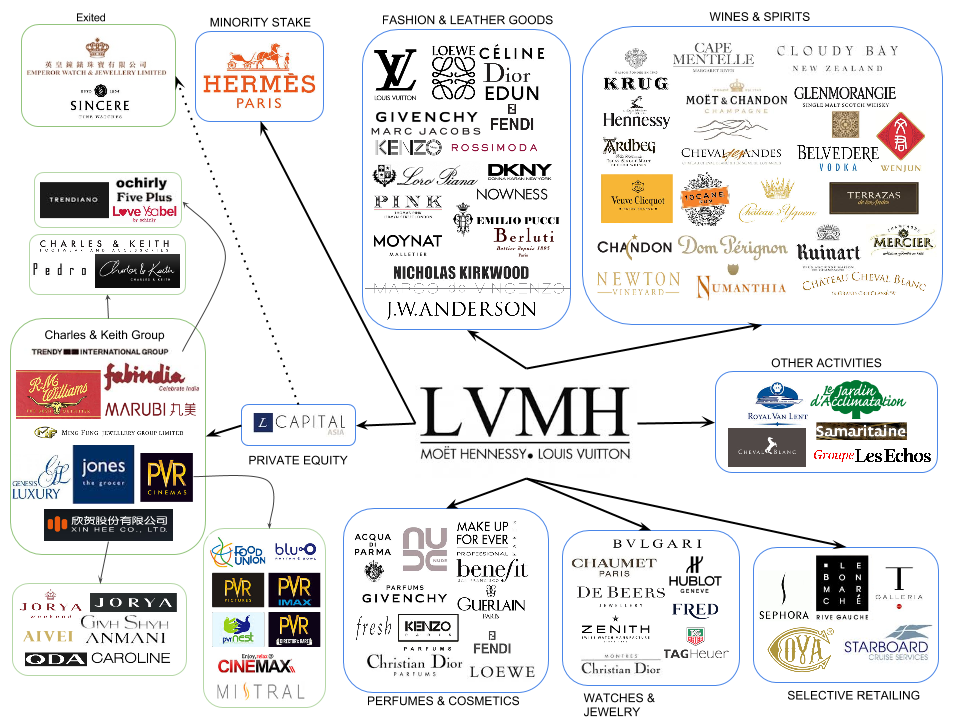

Of the 3 brands, LVMH is the most complicated in terms of ownership structure as could be seen from the diagram above. They have a minority stake in Hermes and a majority stake in Dior.

Luxury Goods Outlook

The growth outlook for the luxury goods market would be likely in the single digits of 6%-8% and could reach EUR360- EUR380 billion by 2025 based on the forecast of Bain and Company.

The revived luxury market has been powered by the resumption of local consumption, the dual engine of China and the US and the consistent strength of the online channel. Younger customers (Gen Y and Gen Z) continue to drive growth and together are set to make up 70% of the market by 2025.

Source: Bain and Company

Click Here for the Full Article:

https://thebigfatwhale.com/investing-in-womens-best-friends-luxury-bag-brands/

Thursday, 3 February 2022

Living to 100 Years Old- Is it a Curse?

Contributed By: The Big Fat Whale

Given the numbers reaching beyond 100, the government is looking to downgrade the award. Currently, the centenarian population stands at 86,510 in 2020 as compared to 153 when the records started in 1963.

100 Year Life

Recently, we just completed reading the 100 Year Life by Lynda Gratton & Andrew Scott and have gained useful insights from their work. What is notable would be if you are in your 40s, there is a 50% probability you will live to 95 years of age. If you are in your 20s, there is a 50% probability you will live to 105 years of age.

What it signifies is that being a centenarian would be a norm rather than an outlier in the future. It brings us to a great paradox of what it entails to our life, society, economy and social structure.

Here is the link for the full article:

https://thebigfatwhale.com/living-to-100-years-old-is-it-a-curse/

Friday, 28 January 2022

ETF to bet against Cathie Woods ARKK- SARK

Contributed by: The Big Fat Whale

Sick of Innovation Stocks that are just hyped up based on concepts with no sight of profits?

There is now an ETF to short against the stocks in ARK Innovation Fund helmed by Cathie Woods.

As Buffet famously quoted:

“Only when the tide goes out do you discover who’s been swimming naked.”

With the easing of monetary policy and access to liquidity drying up, most of the innovation and concept stocks with no cash flow to speak of to sustain their business would be facing a liquidity crunch.

Here is the link for the full article:

https://thebigfatwhale.com/etf-to-bet-against-cathie-woods-arkk-sark/

Saturday, 22 January 2022

Moody's of South East Asia- Credit Bureau Asia

Contributed by: The Big Fat Whale

Credit Bureau Asia has been a stock that we are interested in since its IPO in December 2020 at 93 cents. However, the price has been on an upward trajectory that we missed the move to $1.58 as our value investor mindset sets in.

However, recently the price has dropped back to $1 and it stirs up our interest to take a second look at their business to see if our original bullish thesis is still valid.

Source: Moody's Website

As per our title, when we saw the prospectus of Credit Bureau Asia (CBA), we thought of it as the Moody's of South East Asia where it is providing credit reports and business data to help companies make better decisions. The only thing that might be different would be the pedigree as Moody's was established in 1909- CBA was founded in 1995.

Also, Moody's have the research arm and ability to issue credit rating for corporate bonds but CBA does not have this capability.

Reasons to be Bullish

The most important characteristic that attracted us to CBA is that the margins are rich and there is a strong moat; it is not easy to just set up a credit bureau without any connections. This is especially so in developing countries where CBA have a presence like Myanmar, Cambodia and Vietnam (They have just got a foothold in Vietnam recently through a joint venture).

CBA is also carving out their niche by focusing on SEA where they have an edge over others. Another attractive proposition is that it is in a recession-proof business and in times of crisis, the demand for credit reports and analysis might be even higher. Their business is also not capital intensive and therefore will be able to generate good Returns on Investment.

This type of business model is exactly a Buffet type of business with high margins and a strong moat- Buffet has a 13% stake in Moody's.

Here is the link for the full article:

https://thebigfatwhale.com/moodys-of-south-east-asia-credit-bureau-asia/