If you are heavily invested in China Tech, it is not an easy time in the past few weeks. Baba has fallen by 30% within a week and the end seems not in sight. Even the almighty Tencent was not spared from this perfect storm.

The reasons for their drop could be from the possible implications of delisting from the US, China's regulatory claw and the more likely cause which is similar sanctions imposed on Russia slapped on the Chinese companies.

Would the US and its allies impose drastic sanctions on China? Based on a realistic assessment, it is unlikely to happen as China is playing the neutral role well so far. However, it was also unlikely too for Russia to wage a war on Ukraine without negotiations so it is anyone's guess in this crazy world.

It has been a long while since I saw HSI testing 18000 levels, the way it is going, it looks like they are going into bankruptcy administration. Many of the companies are currently trading close to value stocks status despite their growth characteristics. Tencent at PE of 12 and Baba at PE of 11 (excluding one-off writing down of goodwill).

The Chinese Government have to step in soon unless they want to have a crumpled capital market which will not be in line with their goal of China being strong, independent and vibrant. Statements to provide support for the Chinese market would be most welcome in such dire conditions.

They have shown their prowess and proven their point that no one is on top of the powerful government. Jack Ma is nothing but just a cloud in the sky. Is it perhaps time to spare the rod and shower some care and concern?

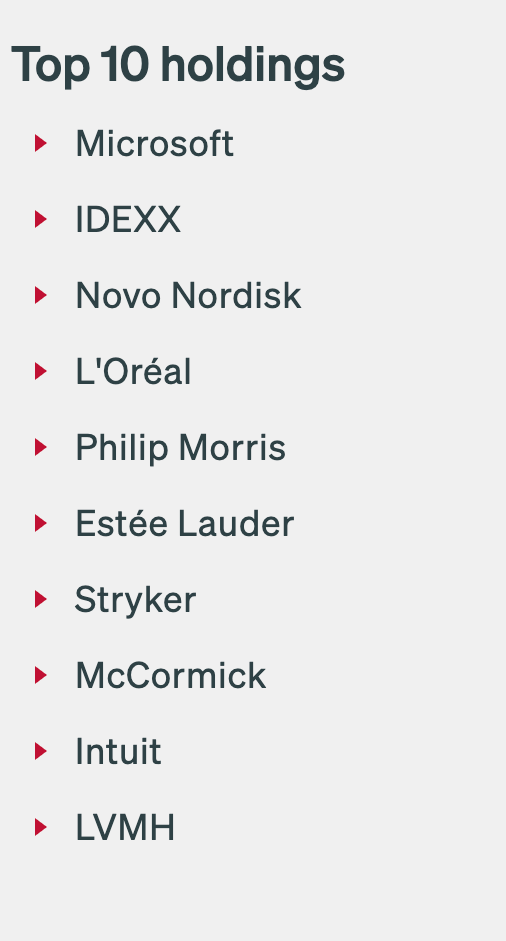

The merits of being able to do valuation of a company based on financials rather than concepts would come in useful at this juncture. If we are convinced China would not let their titans fall, this is the time to be brave and accumulate the "best of the class stocks" in China.

The Graham crowd would be excited to hunt for gems in this current massacre of China's market where Mr Market is getting moody and throwing bargains at us. Even strong names like Ping An is not spared this time around.

Here is some advice from a veteran portfolio manager with 54 years of experience from Royce Investment Partners as he gives his input on how to invest in a bear market. I hope you will find it useful to navigate the current challenging conditions.

What’s your take on the sharp market decline?

I think it was overdue and I believe we have more to go. The reason that I think more drawdowns and declines are likely is the Fed has yet to implement the measures they need to take to restrain and hopefully bring down inflation.

I feel that they’re dramatically behind the curve, meaning that they have to catch up to do. They should have been removing stimulus and should have been raising rates earlier. They haven’t done so. And that’s ahead of us.

Do you think there are other parallels in your career?

I’ve been doing this professionally for 54 years, which means I was actually a young portfolio manager managing a pension fund in 1972-75, also known as the Nifty Fifty era. And this was at a time when, much like the FANG stocks of today, there was an anointed group that sold at very high valuations. We’ve obviously seen this in the dot.com bubble. It repeats itself. So history is a good instructor in these matters.

And the market, from top to bottom, went down 50%. That insight that I learned then was instilled in me by a veteran trader. And he says to me, Charlie, hold your horses. This is the beginning of a bear market. What you’ve got to do is you’ve got to pace your purchases, dollar cost average. You don’t know how long this is going to take.

So what I learned then was a pyramid. What you do is you buy, think of the top of the pyramid, you buy a little. And as the price declines, you buy more. And on days that market goes up, you stop buying, on the presumption, it’s going to go down tomorrow or the day after.

Here is the link for the Full Article:

https://www.royceinvest.com/insights/2022/1Q22/how-a-veteran-pm-invests-in-bear-markets