Contributed By: The Big Fat Whale

Terry Smith is known as the Warren Buffet of the UK and his fund have posted stellar returns of close to 18% per annum since inception in 2011. Like Buffet, he is into investing in good quality companies at a reasonable price. However, unlike Buffet, he never invests in oil and gas companies and also the banks. We got to know about him when we read his book on his investment philosophy.

Would highly recommend everyone to read through this insightful book which is full of investment wisdom and more importantly, it gives you a good guideline on how to choose good quality companies.

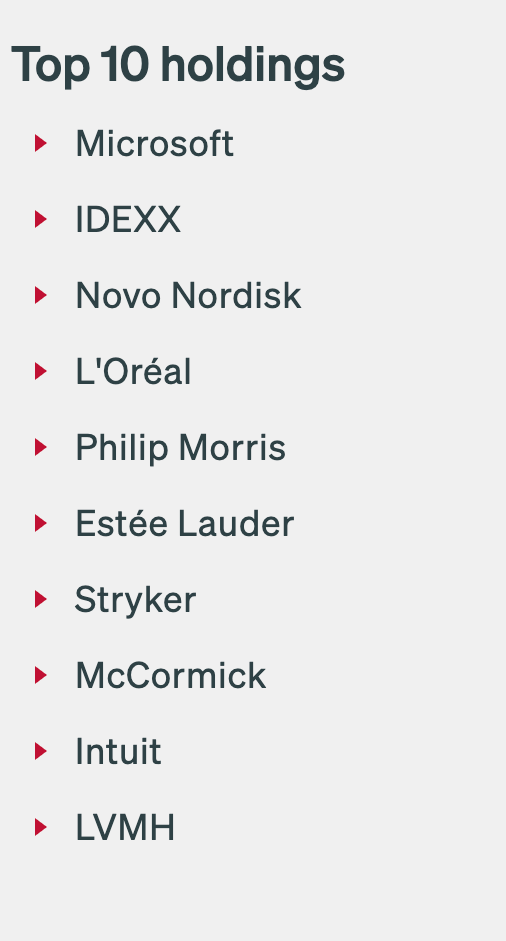

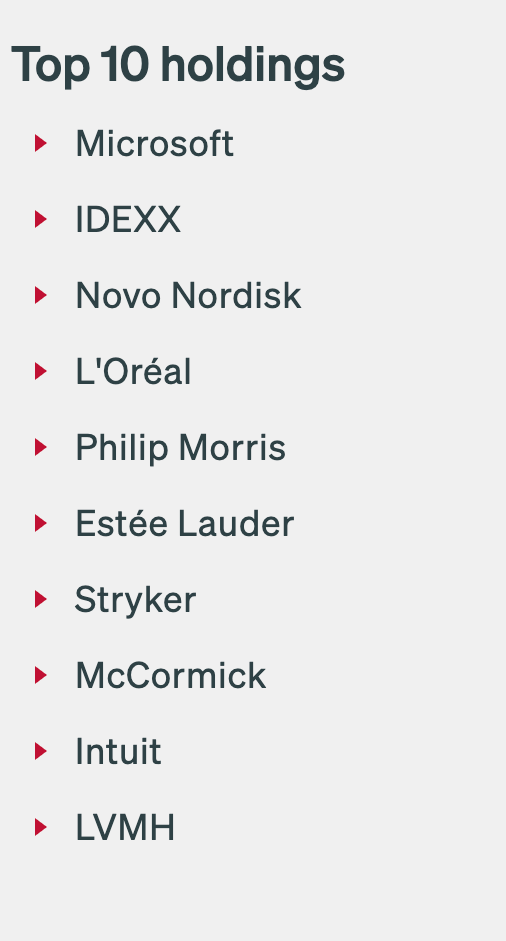

These companies are currently under Fundsmith's top 10 holdings:

Their fund is positioned to have their interest align with their shareholders where there will be minimal turnover which will lead to a lower expense ratio- 0.01% in 2021. The management fee is at 1% with no performance fees embedded in the structure. The Fundsmith Fund could be a potential investment alternative once Buffet and Munger are no longer around- Terry Smith is just 68 years of age and hence there is still a long runway.

The stocks Terry choose are usually those that have a long track record - decades- and have experienced several downturns. This is necessary to validate the resilience of the business that he buys. His main focus would be on healthcare, consumer staples, consumer discretionary and technology.

Just like Berkshire, they also hold annual meetings where they discuss the fund's performance and their views of the market. For this year, it was a virtual event. They shared about the merits of investing in Amazon, Unilever and Meta. The effect of war and inflation was also covered.

Here is the link for the full video to the annual meeting:

https://www.youtube.com/watch?v=Ha2zG4sVTeo&t=8s

In a nutshell, this is a fund that we could consider for our retirement funds. It is only available to accredited investors for those based in Singapore.

We hope you liked this write-up and do subscribe to our website to receive insightful articles whenever they are published.

Disclaimer:

The content here is for informational purposes only and should NOT be taken as legal, business, tax, or investment advice. It does NOT constitute an offer or solicitation to purchase any investment or a recommendation to buy or sell a security. The content is not directed to any investor or potential investor and may not be used to evaluate or make any investment. Do note that this is not financial advice. If you are in doubt as to the action you should take, please consult your stockbroker or financial advisor.