It has been a long while since my last post as I was away to France for a free and easy tour with my family which I will try to do a posting on it. Also, I am currently doing my renovation for my new apartment.

I hope to share my experience for the renovation process so others could perhaps benefit from it and be able do a better budgeting with cost savings in mind.

Before the renovation and short-listing of interior designers and contractors for our home, I have been religiously buying the Home and Decor magazines and also browse the other interior design magazines in the petrol kiosk rack since the start of the year to get ideas for our home. We also google and research on the web whereby renotalk and hardwarezone forums were very useful. There are also individual blogs such as those of Xiaxue and there is one which is really good whereby he actually went to around 10 interior designing firms to get a quote (I can't recall off hand his blog address but will upload it if I managed to find it). Along the way, my wife and I started to short-list those designers that we kind of have a good feel from their portfolio showcase in the magazines and reviews from the web.

We ended up with a final list of 3 Interior Designing firms (1 is from the magazine approach, 1 is introduced by a client and another is my wife's contact) and 1 contractor (Recommendation by a friend).

This is the short-list of things we wanted to do:

1) Hack 3 walls and erect 3 new walls

2) Overlay Kitchen floor tiles and walls tiles

3) New wardrobe for master bedroom and two other rooms.

4) 2.2m full height console

5) 2m full height console for master bedroom

6) Hack master bedroom toilet and total overhaul

7)Overlay floor tiles for common bathroom

8)False Ceiling for Master Bedroom and Son's Bedroom

9)Polish marble floor, parquet and common toilet marble walls.

10)Custom made shelving and study table for son's room.

11) Custom made study table with shelving in master bedroom.

12) Kitchen Cabinets and a standalone cabinet for built in microwave and built in oven.

13) Electrical Works

14)Painting

15)Vanity top and mirror cabinet for common bathroom with a new shower screen

There were some good ideas suggested by the Interior Designers that we have met especially the one that was introduced by my client whom is very experienced in the business. We got quotes from all of them whereby the contractor came in with the lowest quote and we were tempted to pass the project to him as my friend have rave reviews of his work. However, my friend just did his kitchen and not the whole house.

We decided to go with my wife's contact at the end cause we feel an interior designer might be able to execute our theme better. Moreover, his rates are reasonable and not way off the contractor quote. As for the other Interior Designers, their quotes could be around 30-50 percent more than the quote I got from the interior designer that we went with.

Partly, they are from a more reputable interior designing firm which means they do charge 7% GST which my current interior designer and the contractor does not charge as he just started his own company for around 3 years. This could be quite a lot of cost savings which you can utilise to make another wardrobe or for your furniture budget.

That's all for now and I will carry on with further posts on my renovation process. We are in the midst of buying the appliances, furniture, curtains and etc.

Lee

Monday, 2 December 2013

Sunday, 22 September 2013

Parenthood Rebate for Self Employed

This has been a scheme that have been around for a few years but I did not really knew about it till I was browsing through the CPF website a few years back.

This basically allows you to claim up to 3 days of parenthood child care leave from the government. We are granted 6 parenthood child care leave per annum but the government is only going to pay for 3 days. The awareness of this scheme is basically more applicable for those self employed. For those employed, your HR department will handle the claim.

The limit you can claim per day is $500. You can go to the CPF website and under the self employed section, you should be able to find the on-line claim for parenthood child care leave.

For self employed, other things to take note is to try to contribute to your SRS and CPF to reduce your tax liabilities which have been widely covered. For your CPF, you can use it finance your house mortgage payments so I don't see any huge disadvantage in contributing.

As for SRS, you can use it to buy blue chips stocks or unit trust and would be a good supplement to your retirement fund.

The current cap for CPF contribution for self employed is around $30,000 and for SRS will be around $11,500.

Lee

This basically allows you to claim up to 3 days of parenthood child care leave from the government. We are granted 6 parenthood child care leave per annum but the government is only going to pay for 3 days. The awareness of this scheme is basically more applicable for those self employed. For those employed, your HR department will handle the claim.

The limit you can claim per day is $500. You can go to the CPF website and under the self employed section, you should be able to find the on-line claim for parenthood child care leave.

For self employed, other things to take note is to try to contribute to your SRS and CPF to reduce your tax liabilities which have been widely covered. For your CPF, you can use it finance your house mortgage payments so I don't see any huge disadvantage in contributing.

As for SRS, you can use it to buy blue chips stocks or unit trust and would be a good supplement to your retirement fund.

The current cap for CPF contribution for self employed is around $30,000 and for SRS will be around $11,500.

Lee

Wednesday, 21 August 2013

Beware of Leveraged and Representative Exchange Traded Funds

With the evolution of the ETFs market, they now covered numerous products and varieties. You are able to go long or short and you are able to take a leverage position of up to 3X. There is even a Bitcoin ETF in the making.

Most of the interesting ETFs are listed in the US markets whereby some are seriously just not suitable for the normal retail investors due to their structure.

The advantages of the ETFs have been widely preached with empirical studies showing most fund managers are not able to out-beat the market. So a passive approach with lower management fees and expense fees would be considered a more effective way of getting exposure to the markets. However, with the sales charges of most unit trust being cut to close to 0.5%-0.75% and if you chance upon a promotion, it could be even zero percent.

So this brings unit trust to be on a more level playing field. The spread of ETFs plus the brokerage commission could be equivalent to the 0.5%-0.75%. This brings it in line with the sales charge of unit trust. So the only thing that ETFs stand out will be the management fee which usually gives it an edge of around 0.5%-1% per annum.

However, some of us would not mind paying the extra in the quest to find the next Warren Buffet or Peter Lynch whom are able to give us market beating returns.

ETFs are mainly divided into replication and representative types. Replication types usually will buy the physical underlying to replicate the performance of the markets. On the other hand, Representative types are usually structured using derivatives products.

For those who are dealing with Representative ETFs and with added leverage feature, you have to be "Ready to Trade" rather than have a "Buy and Hold mentality". Most Representative ETFs make use of futures products to create a proxy for the underlying. Most futures exhibit Contango characteristics which means longer term futures contract are trading at a higher price than shorter term futures contracts which are usually traded as they are the most liquid.

So whenever the shorter term contracts expired, the ETFs managers would have to roll over to the next contract which they have to get at a higher price so it will lead to an erosion of the Net Asset Value since he can only buy fewer contracts. If you add leverage to the picture, it is definitely not an exciting proposition for buy and hold investors.

Citing an example, Ultra Short Vix ETF (UVXY) which has a leverage of 2X and was trading at around $11-$12 when Vix was near their range low of around 12 in Febuary 2013. Recently, VIX is back to around the 12 level and the same ETF is trading at around $3.5 (Not taking into consideration the 10 for 1 consolidation). Enough Said I Guess.

To conclude, for buy and hold investors, just stick to the normal replication ETFs with no leverage. For those into leverage and representative ETFs, do take it as a trading instrument which I personally will not hold for more than a month, unless it is moving in sync with your intended direction.

Lee

Most of the interesting ETFs are listed in the US markets whereby some are seriously just not suitable for the normal retail investors due to their structure.

The advantages of the ETFs have been widely preached with empirical studies showing most fund managers are not able to out-beat the market. So a passive approach with lower management fees and expense fees would be considered a more effective way of getting exposure to the markets. However, with the sales charges of most unit trust being cut to close to 0.5%-0.75% and if you chance upon a promotion, it could be even zero percent.

So this brings unit trust to be on a more level playing field. The spread of ETFs plus the brokerage commission could be equivalent to the 0.5%-0.75%. This brings it in line with the sales charge of unit trust. So the only thing that ETFs stand out will be the management fee which usually gives it an edge of around 0.5%-1% per annum.

However, some of us would not mind paying the extra in the quest to find the next Warren Buffet or Peter Lynch whom are able to give us market beating returns.

ETFs are mainly divided into replication and representative types. Replication types usually will buy the physical underlying to replicate the performance of the markets. On the other hand, Representative types are usually structured using derivatives products.

For those who are dealing with Representative ETFs and with added leverage feature, you have to be "Ready to Trade" rather than have a "Buy and Hold mentality". Most Representative ETFs make use of futures products to create a proxy for the underlying. Most futures exhibit Contango characteristics which means longer term futures contract are trading at a higher price than shorter term futures contracts which are usually traded as they are the most liquid.

So whenever the shorter term contracts expired, the ETFs managers would have to roll over to the next contract which they have to get at a higher price so it will lead to an erosion of the Net Asset Value since he can only buy fewer contracts. If you add leverage to the picture, it is definitely not an exciting proposition for buy and hold investors.

Citing an example, Ultra Short Vix ETF (UVXY) which has a leverage of 2X and was trading at around $11-$12 when Vix was near their range low of around 12 in Febuary 2013. Recently, VIX is back to around the 12 level and the same ETF is trading at around $3.5 (Not taking into consideration the 10 for 1 consolidation). Enough Said I Guess.

To conclude, for buy and hold investors, just stick to the normal replication ETFs with no leverage. For those into leverage and representative ETFs, do take it as a trading instrument which I personally will not hold for more than a month, unless it is moving in sync with your intended direction.

Lee

Wednesday, 14 August 2013

Van Gogh The Life

Being one of the most famous impressionist artists of the 19th century, this book provide insights and depict in great details on the life of Van Gogh. He lived from 1853 to 1890 and die at a young age of 37. He is more of a loner from young and was never well liked.

This biography touches on the special relationship between his younger brother and himself which indirectly led to his mental condition in the later stages of his life. He started selling art prints at his uncle's art gallery and he only started seriously painting during his late twenties.

As his style differed from the conventional art style which is of the renaissance era, so it was never widely accepted. Monet is part of this new revolution of the impressionist movement.

He led a tough life and depended on his younger brother for allowance as his paintings simply don't sell. He even married a prostitute as a wife who bore him a child. He was a total outcast and spend his later years in an asylum. This was where some of the greatest works were painted.

It is a very sad biography whereby he never reap any benefits from his masterpieces during his lifetime. He was eventually shot and die from the wound. It is still a mystery if he was trying to commit suicide or he was accidentally shot.

This book is around 900 pages and so it took me some time to finish it. After reading the book, it seems that the life of an artist is definitely not as glamorous during those days. Even in today's context, I guess it is still not a preferred route that parents would want their child to take.

Lee

Sunday, 11 August 2013

National Day Staycation

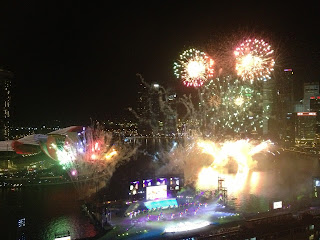

My family have just recently came back from a staycation at Ritz Carlton. We have booked the room hoping to get a room with a view of the National Day Celebrations.

However, it does comes with a premium and so we have to settled for the "Highway View". It can get pretty annoying in the night when u can hear the screeching sounds of the super cars on the road. I am one who seldom soak in the bathtub but at Ritz, it has a bathtub with a view and so who can resist :).

We mainly hang around the Marina Square area these few days and have try different eateries. We had lunch at Dian Xiao Er, dinner at Bao Jin Tian that serves decent dim sum (Custard Buns are really nice) as compared to their 313 Somerset branch. We also try the Sarawak Ko Lok Mee for breakfast which i find is slightly pricey. Had supper and lunch at Killiney and also had a meal at the food court.

We wanted to go and take the flyer but guess it will be really crowded so we give it a miss.

The highlight was of course to watch the fireworks and as our room is facing the highway, so we have to go to the lift lobby to get a glimpse of the spectacular fireworks.

It was a great short staycation for the long weekend. Hope everyone have enjoyed your long weekend too.

Lee

Subscribe to:

Comments (Atom)