Contributed by: The Big Fat Whale

It has been one of the surefire ways to build your golden nest by upgrading from your first BTO HDB to a private property and to another private property every 4-5 years to escape the Sellers Stamp Duty. Not many have not reaped returns using this foolproof path.

There is an interesting Tik Tok video where the content creator was mentioning that his property agent is pitching a newly launched condo as a sure-proof way to lock in profits after 5 years of holding. It is along the line of just buying the property at 1.5 million now and cashing out at 2 million 5 years later.

Then it shows the speech by our deputy Prime Minister who said no one he has known could have predicted property prices in the future. Moreover, this development is situated in a non-prime area which makes the pitch less convincing.

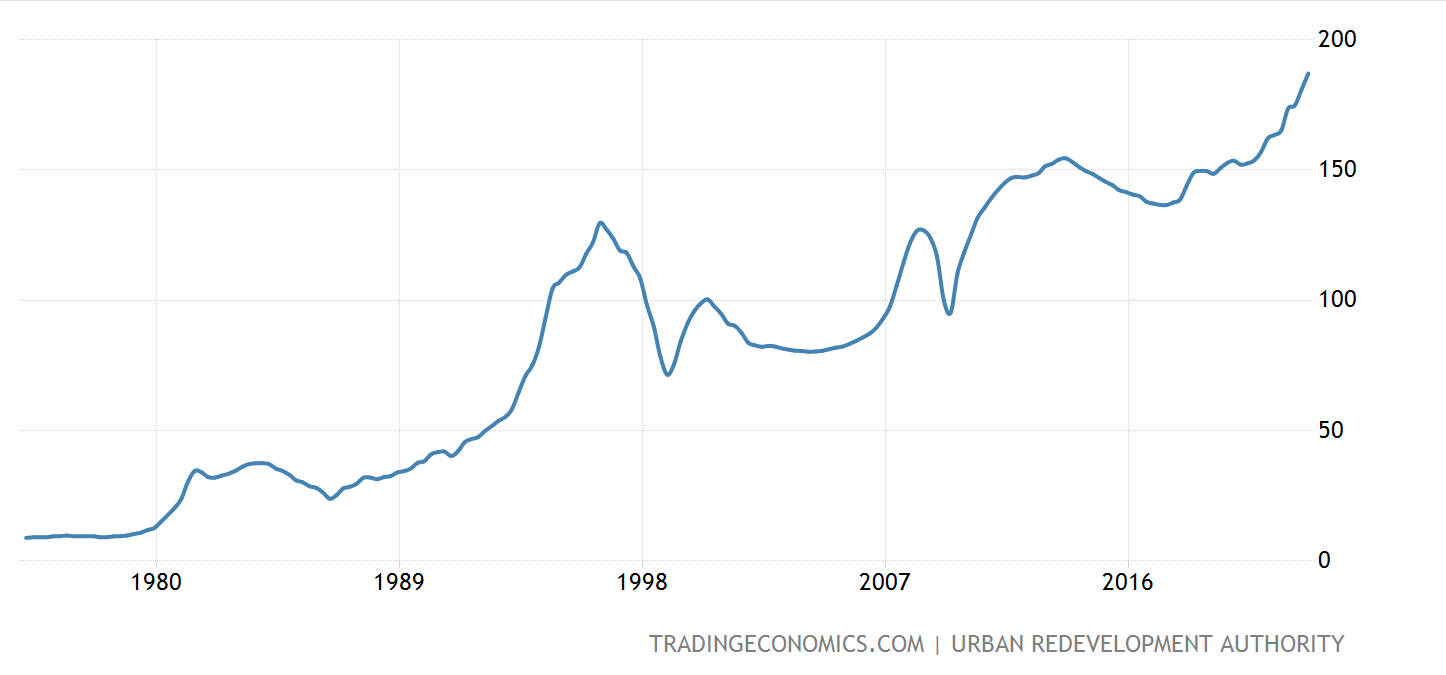

Property Price Trend

Source: Trading Economics- Singapore's Residential Property Price

From the chart above, you can see property prices have been a worthwhile holding if you. have a time frame of 10 years or more. The two notable periods where there was a profound correction would be the Asian Financial Crisis in 1997 and the Global Financial Crisis in 2008.

During the Asian Financial Crisis, prices plunged close to 40% and it took nearly a decade for those who got at the peak to be back to breakeven in 2007. The stock market declined by 60% during this period. We can affirm this as a friend who bought a condo unit at the peak of 1997 saw his property valuation come back to breakeven only ten years later. It is his version of the "Lost Decade".

Click Here for the Full Article:

/https://thebigfatwhale.com/likely-property-crisis-for-singapore/