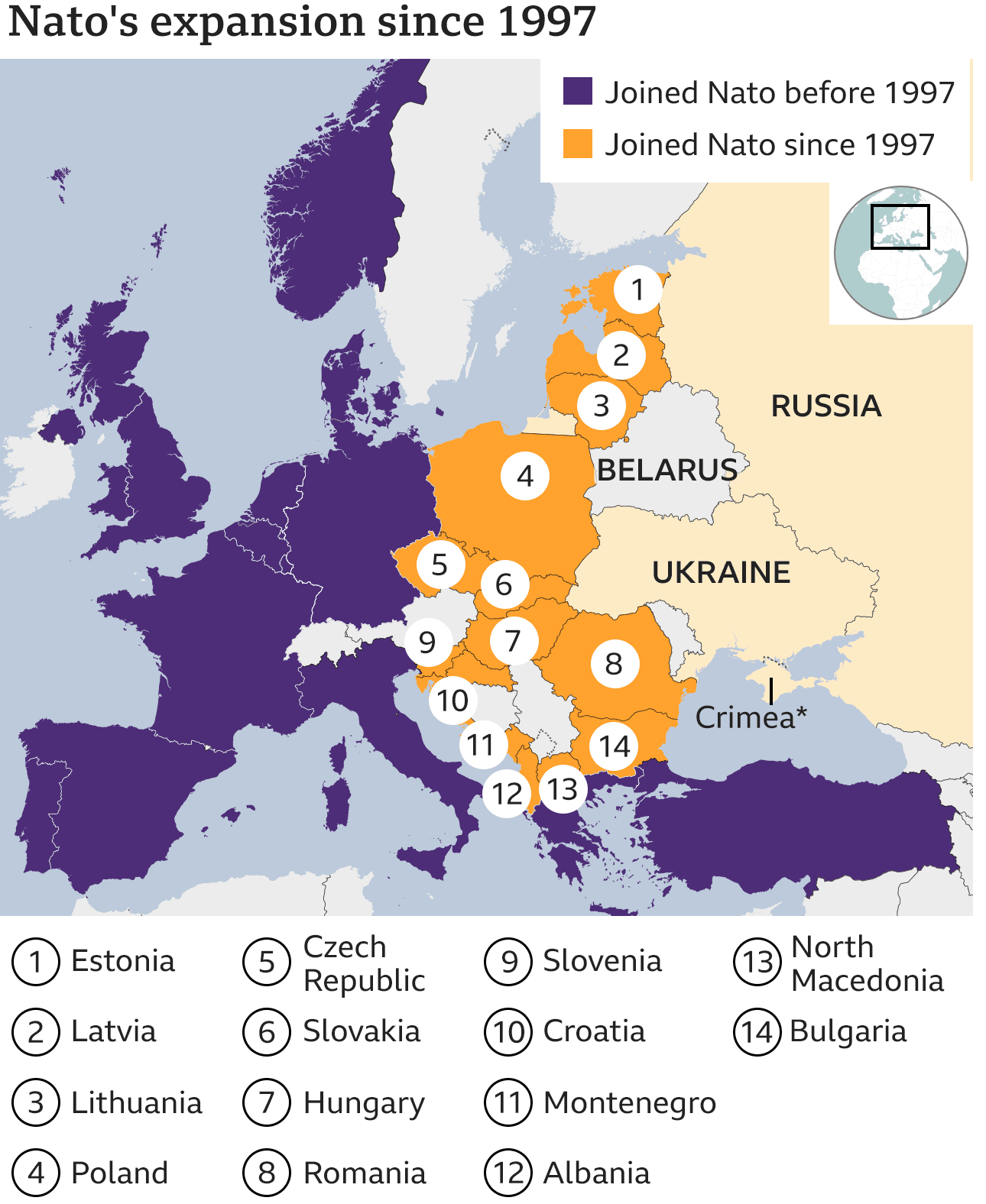

In the midst of the current gloom and doom of the war coupled with the fear of economic armageddon- tech and innovation stocks have already felt the ripples, it is good to take a step back and reflect on what really matters.

Over the weekend, I have caught this 2009 movie, Hachi: A Dog's Tale, featuring Richard Gere. It is based on a true story in Tokyo during the 1920s of a Japanese college professor and his dog. The professor passed away in 1925 due to a brain haemorrhage. The dog continues his daily ritual of waiting for his owner at the train station for 9 years before passing away.

There is a statue erected in memory of Hachi at the Sibuya Station where he has waited for his owner.

It certainly brings many thoughts such as life could be really simple with a simple goal such as for Hachi; which is to see his owner once again. The devotion, dedication and determination are what every one of us could learn from.

So if we desire a simple lifestyle, we could gain financial freedom earlier and do what we love and desire instead of it being another job. With the ever-increasing expectations- a bigger home, a better car and an ideal lifestyle- that society is piling on us and with simple goals- owning a home- fleeting away due to it being out of reach, it has even inspired the "Lying Flat" movement in China.

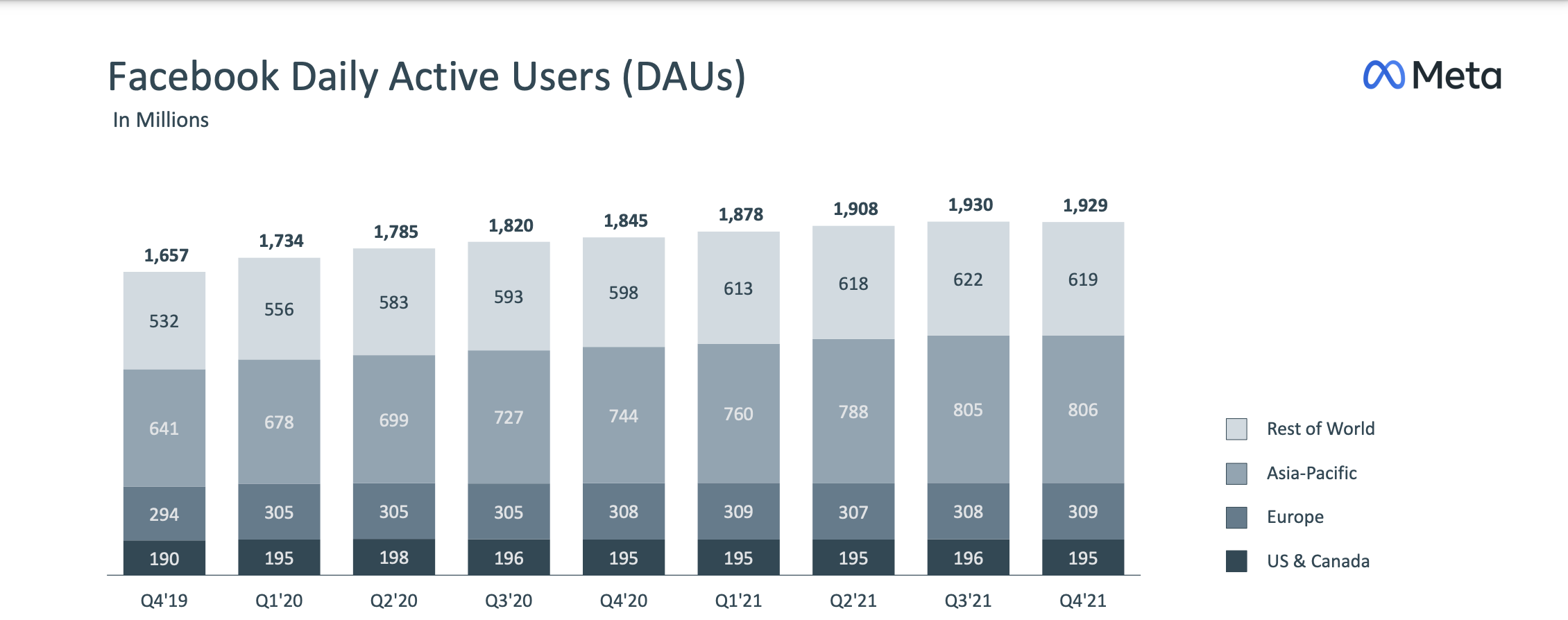

The advent of technology and social media, it has led to their own set of problems such as cyberbullying, wastage of productive time, scams and misdemeanours. Nonetheless, from the productivity angle, it has really helped to boost up the economy and address workers shortage issues.

I would strongly recommend this show as it would evoke not only emotions but hopefully self-reflections in these challenging times. It will make us more appreciative given that there are many that are worse off than us- imagine those in the war zone now.

Hope everyone would enjoy the show as much as I do.

Life could indeed be very simple and meaningful.

Here is the link to the actual Hachi story: