Contributed by: The Big Fat Whale

Recently, I have been looking up Oracle's financials to see if it is something that I would add to my watchlist. In a usual filtering process, using value investing metrics such as Price to Book, Debt to Equity and Return on Equity, Oracle would never appear in the list.

The reason being it is having negative equity. In simple terms, when you take their total assets and net off their total liabilities, they are coming in with a shortfall.

So it brings us to the question:

Are Negative Equity Stocks an Outright Sell?

Negative equity stocks, also known as “underwater stocks,” are shares of companies that are trading below their book value or the total value of their assets. In other words, if a company has more liabilities than assets, it can result in negative equity. While negative equity might seem like a cause for concern for investors, there are situations where it may not necessarily be a bad thing.

Why Negative Equity Might Be a Cause for Concern?

Negative equity can often be a red flag that something is not right with a company. It could indicate that the company has taken on too much debt or made poor investments, leading to financial troubles. In such situations, the company may struggle to pay off its debts and interest, which can lead to bankruptcy.

Negative equity may also be a sign of declining or stagnant revenues. If a company is losing money and not generating enough cash to cover its operating costs, it could result in a negative equity situation. This may be due to increased competition, changing market conditions, or poor management decisions.

Why Negative Equity Might Not Be a Bad Thing?

While negative equity might be a cause for concern in many cases, there are situations where it may not necessarily be a bad thing. For instance, a company with negative equity may have a large number of intangible assets, such as patents or brand value, that are not reflected in its book value. Such companies may be worth more than their current market value, even if their book value is negative.

Say, for example, McDonald's is one of the world's most recognisable and valuable brands, the brand value is estimated at 42 billion dollars. On their books, it is only valued at less than 2 billion dollars.

The value will only emerge when the business is sold with the total brand worth (the additional 40 billion dollars) highlighted as goodwill in the acquiring company accounts.

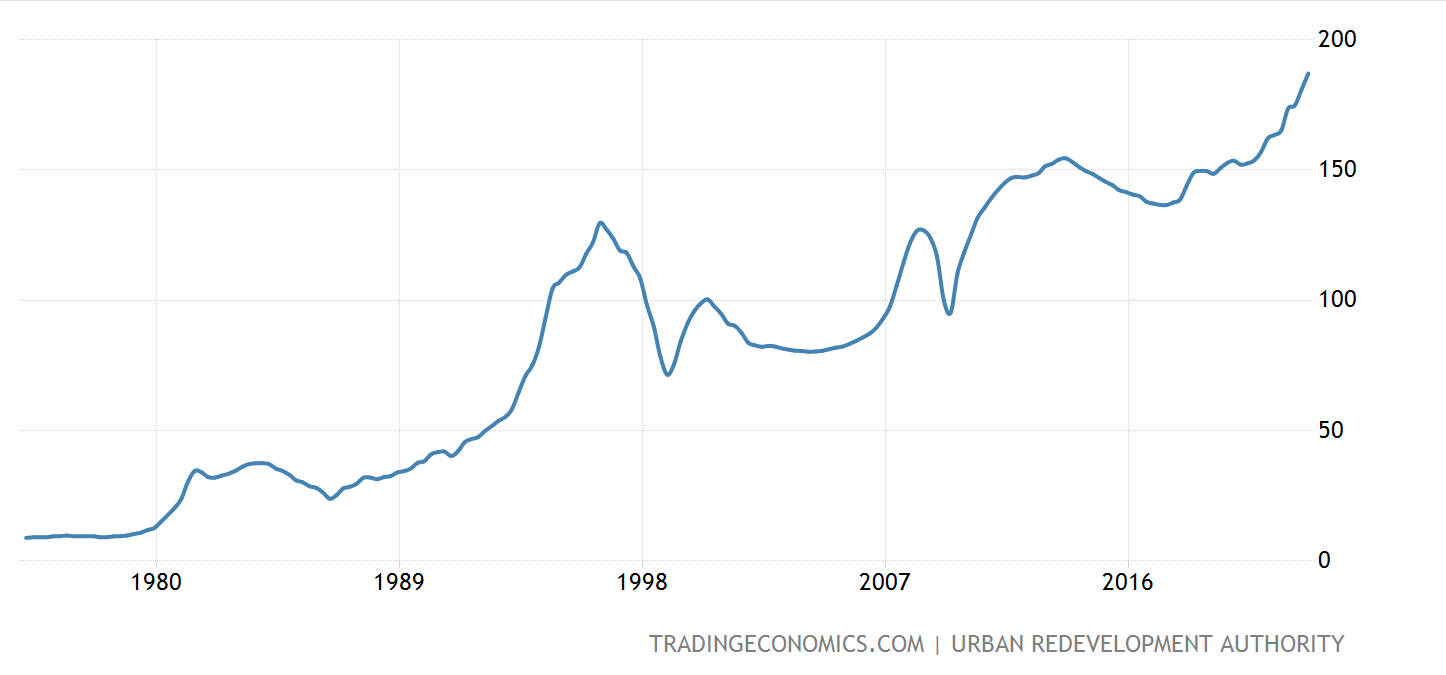

Market Values vs Book Values (In Millions) - Credit: OShaugnessy Asset Management

Also, when companies are acquiring other companies, the intangible assets/goodwill would be subjected to writing off on a gradual basis. So using back the McDonald's example, the 42 billion dollar brand value would see a write-off every year, despite the Mcdonald's brand value might be getting more valuable through advertising strategy and etc. The effect on the financial statements would be lower profitability and hence lower book value.

The company could also be buying back their shares in an aggressive mode or paying back huge dividends that would have an impact of turning the company into a negative equity situation. Even Apple, thou it is not in negative equity, Apple has negative retained profits as the company have been aggressively buying back its shares for the past few years.

Another reason why negative equity might not be a bad thing is when a company is undergoing a turnaround or restructuring. If a company is making strategic changes to its operations, such as selling off unprofitable divisions or reducing debt, it may be able to improve its financial position over time. In such cases, investors may see an opportunity to buy the stock at a lower price before it turns around.

Are Negative Equity Stocks an Outright Sell?

From a Singapore market perspective, I believe it is usually the case as negative equity stocks are not very common. It is negative equity for the right and logical reason, which translates to the company being in distress.

However, the US markets have lots of good quality companies that have been in negative equity situations at some point in time. Some examples will be Home Depot, McDonald, Yum Brands and Oracle.

Instead of writing a negative equity stock off, if the company have strong branding or is an established name, we should look beyond the trees. There could be other metrics such as revenue growth, profit growth, interest coverage and positive operating cash flow that we could look into. If there is a contradiction to the base thesis for the negative equity scenario which is a red flag by itself, we should revisit the investment decision.

As for Oracle, I am still in the midst of my research. The huge negative equity figure could be due to their huge acquisitions through the years and goodwill have to be written off that could have led to a negative equity situation. After saying that, their acquired companies could be worth more than what they are acquired at which the negative equity is more an accounting exercise than what Oracle is actually worth.

Given that their software solution and Java program create a sustainable moat for the company, I will not be too bothered by the negative equity situation. Nonetheless, at a PE of 30, there could be a better entry level.

To sum up, being in negative equity does not mean it will be an outright sell but more due diligence would be needed if the company is an attractive investment based on its growth and earnings prospect.

Disclaimer:

The content here is for informational purposes only and should NOT be taken as legal, business, tax, or investment advice. It does NOT constitute an offer or solicitation to purchase any investment or a recommendation to buy or sell a security. The content is not directed to any investor or potential investor and may not be used to evaluate or make any investment. Do note that this is not financial advice. If you are in doubt as to the action you should take, please consult your stockbroker or financial advisor.