Contributed By: The Big Fat Whale

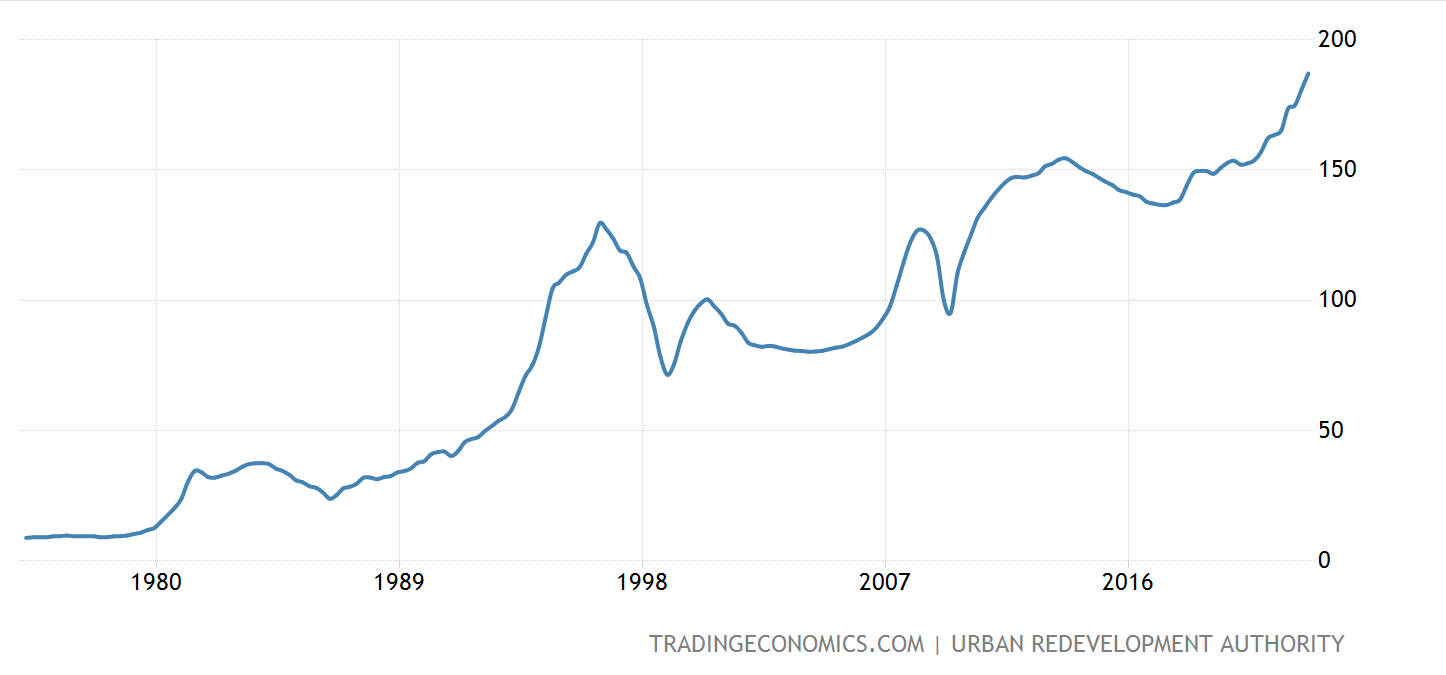

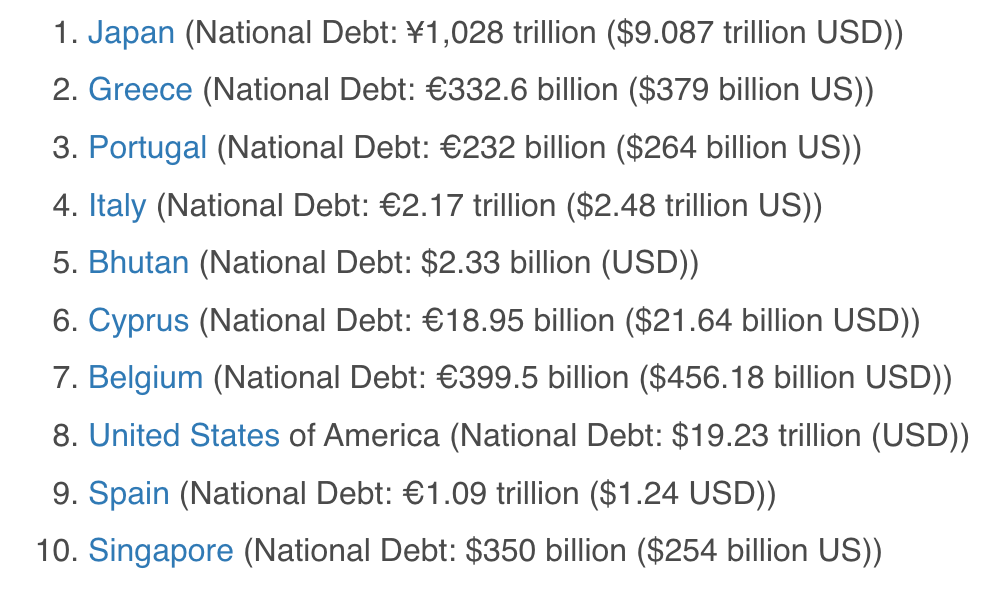

To be frank, we were very surprised when we saw Singapore at the top of the table for countries with the highest government debt to GDP. Is it a worrying sign? Or is there more to it than what the figures are implying?

Therefore, we decided to take a deeper look by doing some research.

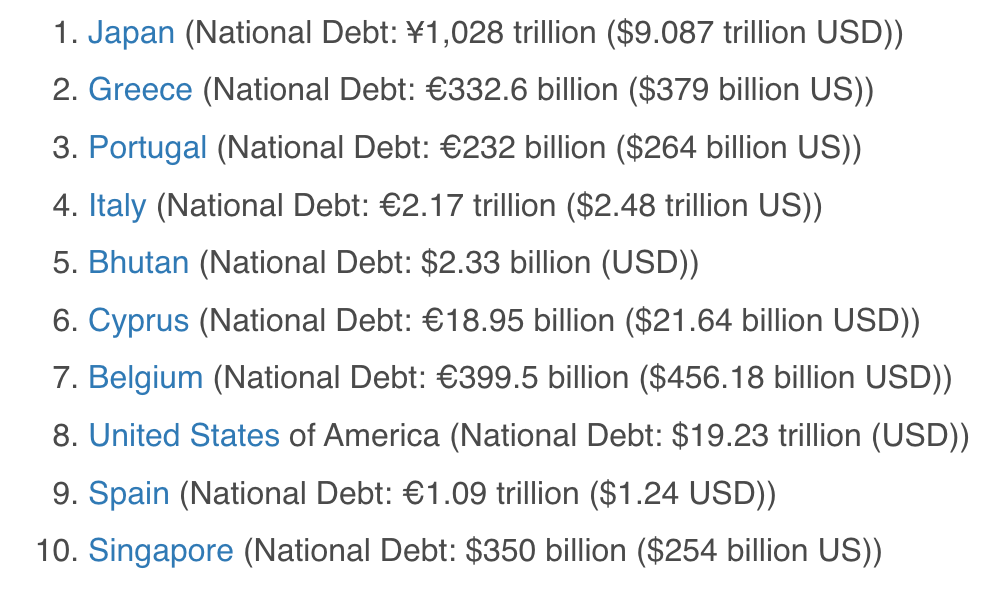

Source: worldpopulation.com- Top 10 countries with the highest Debt to GDP in 2022

Debt Instrument Issued

Firstly, let's break down the different debt instruments that the Singapore government issued for their debt.

- Singapore Savings Bond

- Singapore Government Securities

- Special Singapore Government Securities

- Treasury Bills

Singapore Savings Bond is issued to give Singaporeans a debt instrument they could invest in to grow their money efficiently and safely to counter inflation. They are issued with a 10 years tenure and could be redeemed at any time with no loss of capital.

Singapore Government Securities is issued to promote the debt market in Singapore and could be used as a benchmark to price corporate bonds. They are issued with maturities of 2, 5, 10, 15, 20, and 30 years.

Special Singapore Government Securities are issued to provide returns for Singapore's State Pension, the Central Provident Fund. The securities earn the CPF Board a coupon rate that is pegged to the CPF rate the members receive.

Here are some details of the interest that members will receive. The member will earn 5% per year on up to the first $60,0000 of their Retirement, Special and Medisave Accounts if their Ordinary Account is less than $20,000. Also, they earn an additional extra interest of 1% per year on the first $30,000 of their CPF balances after age 55. This means they can earn up to 6% per year on the first $30,000 in their Retirement Account.

Treasury Bills are short-term debt instruments that are issued with a 1-year maturity. It is used to bridge and smoothen the cash flow from the operations of the government on a day-to-day basis.

Is Singapore in a Precarious Situation?

Singapore's government mainly borrow money not to fund the running of the country which is usually depicted in the yearly budget. In recent times, the UK is trying to borrow more so as to fund its proposed tax cuts and it has led to an all-time low for the sterling.

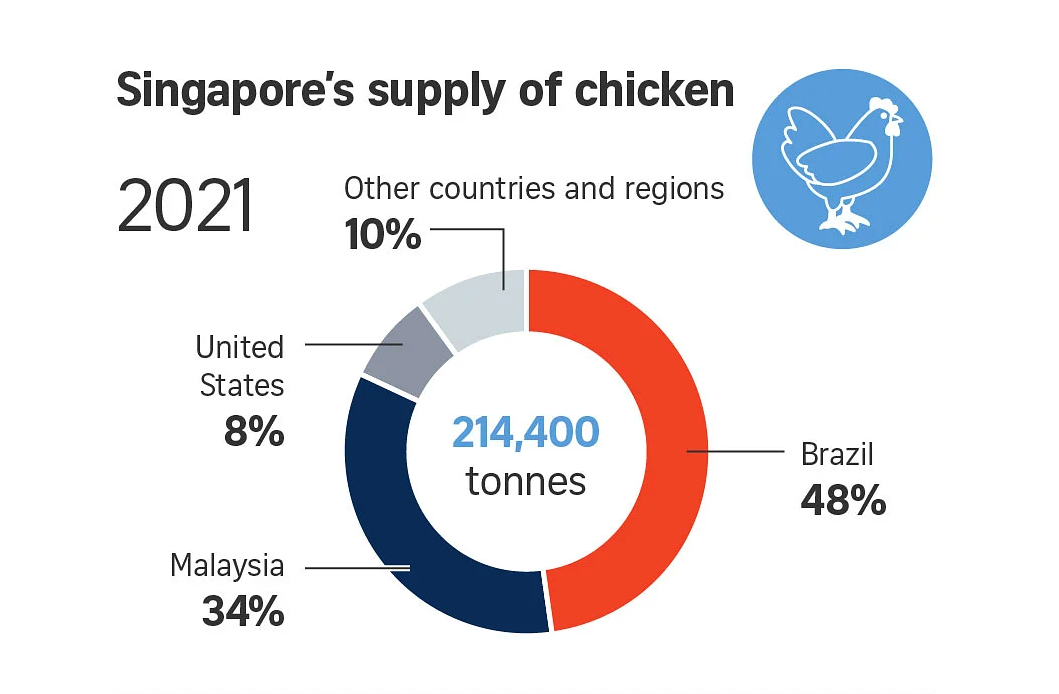

Singapore's government borrow to fund infrastructure projects that will turn into assets once they are completed. Some notable projects funded by past government debt are the large initial costs for Changi Airport and the first MRT lines in the 1970s and 1980s, There will be cashflow from the funded projects after completion which will lead to generating investment returns and contribute to the revenue of the nation.

Projects that will be financed by the government debt in the future will be the expansion of rail lines, major highways, other green projects and more importantly a sea wall that will protect Singapore from rising water levels due to climate change.

Based on Singapore's constitution and government securities act, it is not allowed to spend the funds raised through debt securities. Therefore, the bulk of it is invested in infrastructure projects that have national interest.

There are also safeguards to rein from an overdose of debt for infrastructure with a cap currently at 90 billion dollars which is around 20% of current Singapore's GDP.

Singapore is One of the World's Top Net Creditor

Source: Brookings

From the computed statistics shown, Singapore is one of the top net creditors according to the share of GDP in the world. Therefore, based on our earlier discussion, if we take the value of the assets that were financed by the debt, and deduct the debt amount, we are in a very healthy position.

Summing Up

Headline figures of 130% of government debt to GDP for Singapore would send uneasy signals if we do not look deeper into the figures.

So based on our research, the debt is used to finance mainly infrastructure projects that would generate investment returns in the future once completed. With these turning into cash-generating assets, the implication would be that Singapore is actually a net creditor when we take the assets minus the debt.

On top of that, the reserves of Singapore which are managed by MAS (S$510 billion), Temasek (S$381 billion) and GIC (In excess of S$100 billion) as of 31st March 2021, which would put us in good stead to face any turbulence ahead with a trillion dollars of a buffer.

We hope you liked this write-up and do subscribe to our website to receive insightful articles whenever they are published.

Disclaimer:

The content here is for informational purposes only and should NOT be taken as legal, business, tax, or investment advice. It does NOT constitute an offer or solicitation to purchase any investment or a recommendation to buy or sell a security. The content is not directed to any investor or potential investor and may not be used to evaluate or make any investment. Do note that this is not financial advice. If you are in doubt as to the action you should take, please consult your stockbroker or financial advisor.